GM, legends!

It’s VIVA LA CRYPTO as Bitcoin beat the banks this week and stays steady at over $24,000. Credit Suisse almost collapsed while Ethereum withdrawals flew under the radar with the Goreli Testnet being a complete success.

Today we’re looking at why Bitcoin is the big winner, as well as 12 project updates that bring hopium back into the month of March.

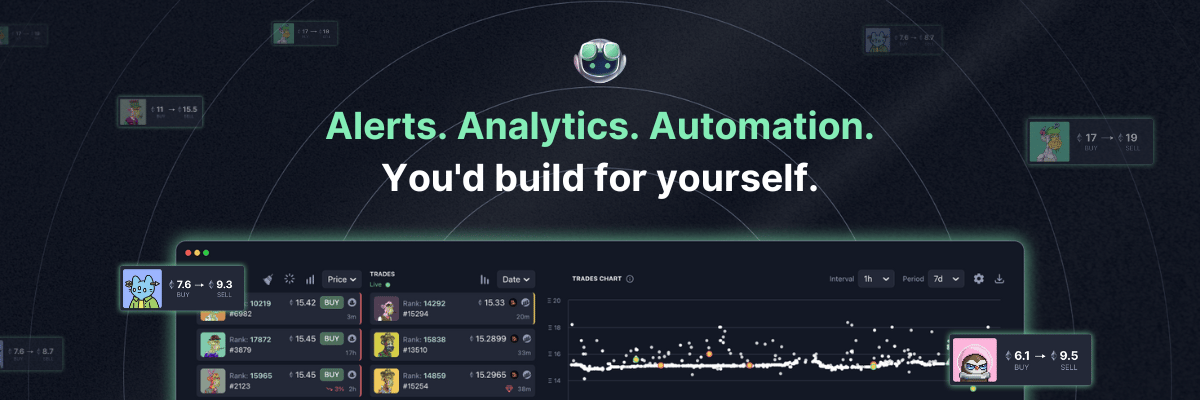

Before jumping in, today’s edition was brought to you by

Copilot, the NFT Analytics, Alerts & Automation dashboard

Copilot is the NFT Trading Platform you'd build for yourself. We are currently in free beta testing and are looking for traders who want to build a platform that's customized to their needs. If you are always missing something in every product, don't settle for less - trade with Copilot.

Here's what's inside today.

🔥 The big topic. VIVA LA CRYPTO, Bitcoin beats the banks!

🗞 Hot crypto news. Permabull Cathie Woods’ NEW private crypto fund, Fidelity Investments stealth launch crypto product, is Shib’s “honest mistake” just fud?! AND MORE.

👀 Updates across the bloc. GearBox Protocols V3 Teaser, Spool Finance partner with Fox Wallet (big update), IPOR labs will list on BitGet AND MORE.

🛡 Chart of the day. It was too good to be true… $BTC

🧵 Thread of the day. Louround creates 9 of the most useful Twitter lists from DeFi degens, alpha calls and giga brain PhD crypto researchers.

🔥 The big topic.

VIVA LA CRYPTO, BTC beats the banks!

VIVA LA CRYPTO, Bitcoin succeeded where the banks failed this past weekend.

As the plot thickens, operation “nuke crypto” deepens.

What’s transpired over the last seven days is nothing short of shocking, confusing and downright annoying as the regulators have successfully put a halt to UP ONLY (again)!

The Story So Far

Three crypto-friendly banks have been wiped out with Signature Bank being the most suspicious of them all.

Regulators sending a strong message to the industry to “stay away” whilst Jim Cramer continues to mark the local top for Bitcoin and handed Silicon Valley Bank (SVB) the kiss of death last month (what did he know?!).

The coordinated FUD attack that has been nailing us recently has become a full-blown banking crisis that, right now, is taking absolutely zero prisoners.

On and off ramps are being shut down, and banks are getting absolutely rekt leaving investors, apes and these banks worried about what happens in the next chapter.

Bitcoin Beats the Banks

Game on as Bitcoin takes the lead in the first half of this battle.

Firstly, centralised banks have undermined the confidence of the consumer, their investors and the depositors who put their trust in them to store their hard-earned cash.

Bitcoin might leave you underwater but it’ll never break your trust as it does exactly what it says on the tin.

From a FED-induced boom to bust to re-adjust, if a bank run ever happened on fiat you might be able to use your bag of Bitcorns down your local Tesco.

Secondly, is predictability. Oh yes, good old-fashioned, boring predictability. Blocks were made, Ordinals inscribed and the Bitcoin maxis well… did what they do best with their laser-eyed Twitter pics.

Thirdly, it just works. It’s a store of value that doesn't give you an IOU when it takes your cash and makes bets on risky investments as it gives the power back to you.

Plus, Bitcoin is simply just cool AF, highly memeable and way more fun to talk about.

Our Take

We said it was going to be March madness but even this crew of apes didn’t expect what’s happened.

Bitcoin has totally beaten the banks. And we know that somewhere out there Satoshi will be smiling away in a dark basement.

Seeing as three banks just got TKO’d by regulators because “they’re into crypto, bro” has definitely set off some alarm bells with uncertainty looming.

The FED is going to need to do something. Because this sneak attack has royally fluffed up on them given that what used to be “safe” investments for banks (treasury bonds) have proven to be worse than that Cardano investment we’ve all made and never admitted publicly to.

🗞 Hot crypto news.

🐮 Bullish News

Cathie Woods’ NEW private crypto fund. The long-term crypto bull and innovation specialist has raised over $16m for the opened ended fund, splitting it between the Cayman Islands and Domestic holdings. News came after Ark added more $COIN shares to the $ARKK and $ARKW portfolios. Cathie, please pump our bags! (link)

Fidelity Crypto’s stealth launch goes live in the middle of a banking crisis. The financial services giant now offers its 37 million customer base access to Bitcoin and Ether investments beating off the competition. (link)

Gensler clasping at straws in his latest attempt to “make crypto great again”…sorry… I meant to say “suggests proof of stake tokens are securities.” However, the Commodity Futures Trading Committee says otherwise. (link)

🐻 Bearish News

Shibs “honest mistake”? or was it forked plagiarism as the origin of the Shibarium blockchain comes into question after allegations were made that the code was stolen? A discord user pointed out that the testnet Chain ID number, 917 was the same as Rinia testnet. A lot of crypto is open source and a lot of code gets copied with the full launch of Shibiarium likely being far off. (link)

Instant payment with FEDNOW! Sounds like a fork of TVNOW but the Federal Reserve launches the program in July. Financial institutes will be able to offer instant payments between consumers, merchants and banks. Wait a minute…that sounds like Signature Banks Signet and Silverbanks SEN. Bullish? or Bearish? You decide! (link)

Credit Suisse in Crisis. In the last 24 hours, Credit Suisse saw its stock reach new all-time lows after its biggest backers showed little sign of support. The Swiss Central Bank has offered a $54 billion lifeline loan to help regain investor confidence. Meanwhile… 👇 (link)

👀 Updates across the bloc.

Project Updates

Divalabs a liquid staking derivatives protocol will be officially launching post-Shanghai upgrade letting their stakers deposit and withdraw from day 1! (link)

Ethereum sees success as Goreli has been successfully upgraded to Shapella. The next stop will be mainnet meaning Ethereum withdrawals are right around the corner! (link)

Gearbox Protocol’s V3 teaser and full details in their latest medium article where they will be redefining leverage and lending. Expected in Q2 after the audits have been completed. (link)

GumBall Protocol gives an early look into what coming in V2/V2.5 including physical NFT redemptions, fair mint WL pools, Game-Fi economy contracts and more. (link)

IPOR Labs gets listed on BitGet on March 22nd. (link)

OPNX Exchange, founded by the now infamous 3AC, has released information on their $FLEX token with more updates on staking and incentives coming soon. And yeah, yeah, we know... But hear us out, they’ll want to make some of those lost funds back, so there might be $$$ on the table. (link)

RockX release Bedrock, a liquid staking protocol that’s designed for both DeFi & CeFi. (link)

Spool Finance has just announced its new partnership with Fox Wallet which will include listing the Spool app and $SPOOL token on its discovery page. (link)

Threshold Network is creating a fully Bitcoin-backed stablecoin thUSD with on-chain reserves and permissionless minting based on Liquity Protocol using tBTC as collateral. (link)

UniSwap officially launches over on the Binance Smart Chain making UniSwap more accessible to the BNB degens. (link)

Unstoppable DeFi’s public fair launch takes place on March 29th. There are no VCs, no pre-sale, no private rounds, and no whitelists! (link)

Governance Proposals

Ribbon Finance releases its latest proposal marking the first important for the imminent arrival of Aevo, a next-generation options platform which will be integrated fully into Ribbon Finance. This proposal will look for Ribbon DAO to lend $1m to the Aevo Insurance Fund to bootstrap it. (link)

🛡 Chart of the day.

Is $BTC.D signalling an altcoin rally?

Check it, we are hitting, on the RSI, a major downwards slopping resistance on the weekly timeframe for Bitcoin dominance and the last time we bounced off it in June ‘22 we had a face-ripping altcoin rally.

Is the BTC.D chart showing us that, once this turbulent month is over that altcoins might catch a bid into a sensational summertime?

Bull case. For Bitcoin to reach $31,000 we need to BTC.D chart to keep on pumping back towards the 48% marker

Bear case. There isn’t really because if BTC.D starts to fall, chances are… altcoins will pump. Buuuut as always NFA dyor, TA often fails 🫠.

Coming up next week.

FOMC on Wednesday is what we are all waiting for. At the time of writing the markets are pricing in a 66% chance of rate hikes (link).

🧵 Thread of the day.

How many times each week do you tell yourself you’re going to make useful Twitter lists? Yeah… us, too. Louround did the hard work so we didn’t have to from DeFi degens to alpha calls to giga-brained PhD crypto researchers.

Probably the most useful thing you’ll read this week.

And on that note, thanks for reading, catcha apes in the next edition!

blocmates team 🫡

Give us your feedback

🤝 A final word.

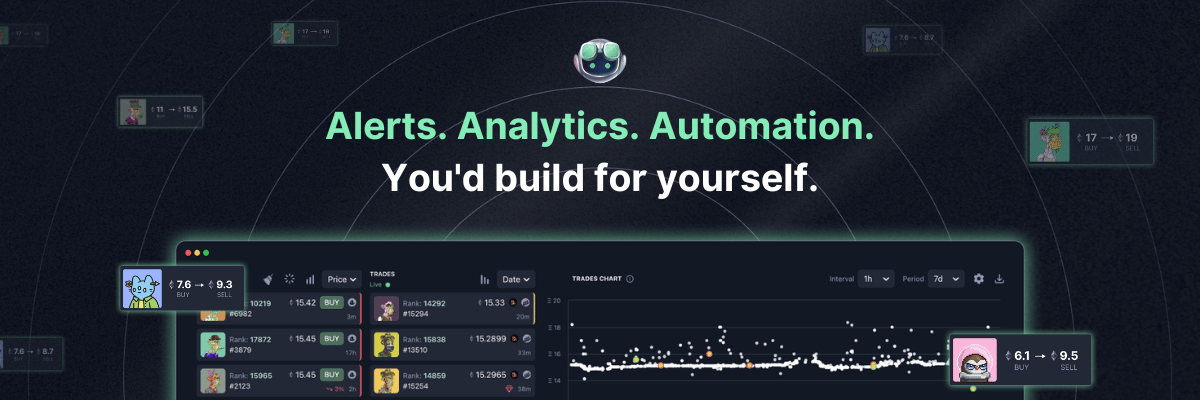

A quick word from our super awesome sponsors Copilot who help made this edition possible...

Copilot the NFT Analytics, Alerts & Automation dashboard you’d build for yourself