🗞 Market commentary.

GM, dip slurpers.

So, there we have it: Pentoshi's prediction is manifesting once again. About two weeks ago, we mentioned the TOTAL3 chart (all of crypto except ETH and BTC) looking bleak and, in accordance with what Pentoshi drew out for us, agreed that we might need to retest 640B levels. A quick glance at the TOTAL3 now confirms we're on exactly the pre-written trajectory. As the altcoin market erases paper profits and tax season rolls on, it's crucial to keep in mind that the final target is almost reached. Moreover, we need to remember the grand vision and speaking of Pentoshi, he himself sees Bitcoin reaching $180K sometime during 2025 and 2026. What does that tell us? Selling now or even lower might not be wise – instead, it could be our last chance to stock up.

Now, the last thing we need to figure out is how and where to get paid at least $1,575 per hour, but for that, we might need to become the next big exchange bankruptcy CEO, similar to current FTX’s John Ray III.

📊 Luke’s Chart of the Day

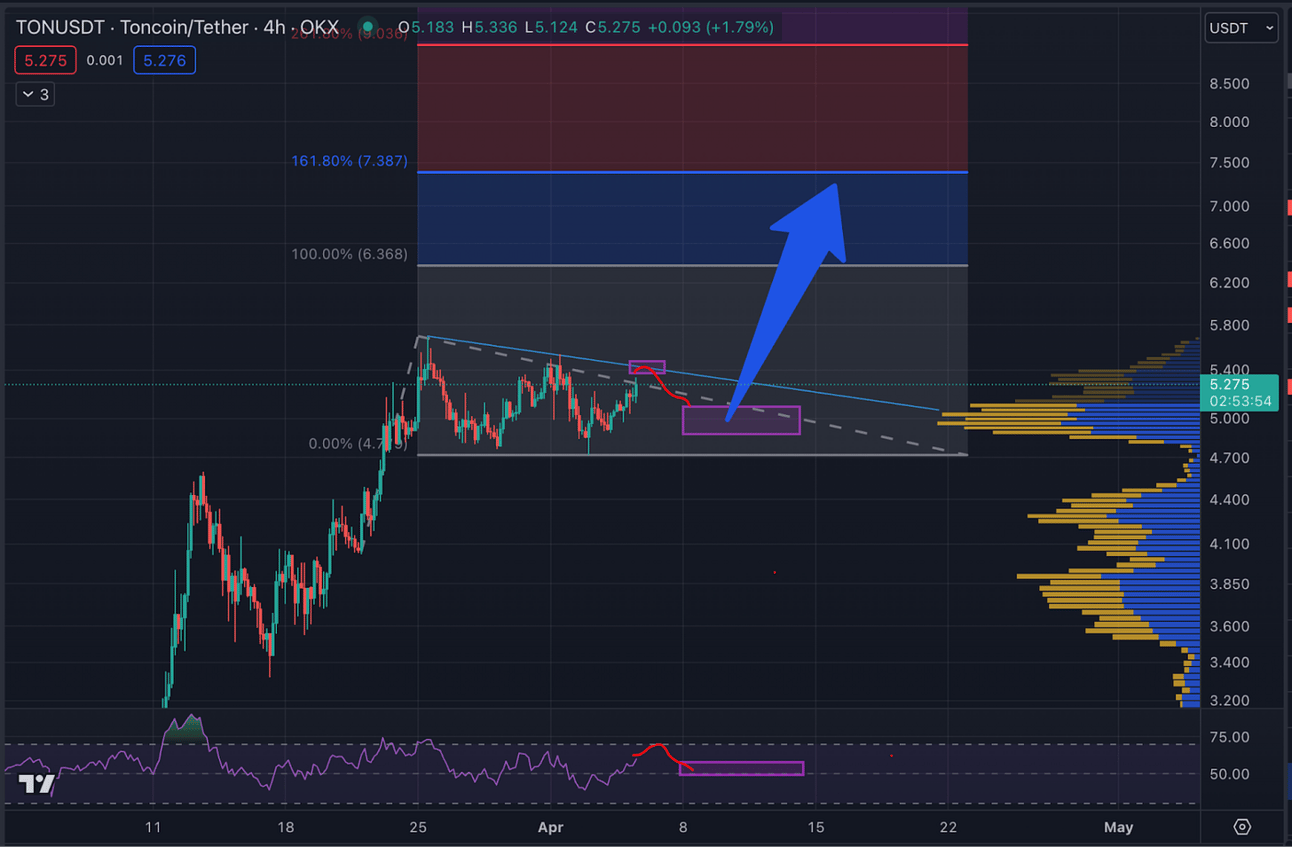

TONUSDT 4H

I had to hunt high and low for a bullish chart today, but I found one in Toncoin, the Telegram payments coin that is going from strength to strength. DWF are market making up a storm on this chart. Today, we have a nice double bottom forming. Either we go up to the trendline and fall back down to the bigger purple box (solid support), or we may just break the trendline and go up from here. That does seem a little unlikely, given the marketwide bloodletting at the moment. A modest 1.61 fib extension target will put us at roughly a $7.40 price target for an eventual breakout.

Come by the Lucky Luke Discord channel for comments, to roast my picks, or to pump your own bags. All banter is welcome anytime!

🔥 Degen corner.

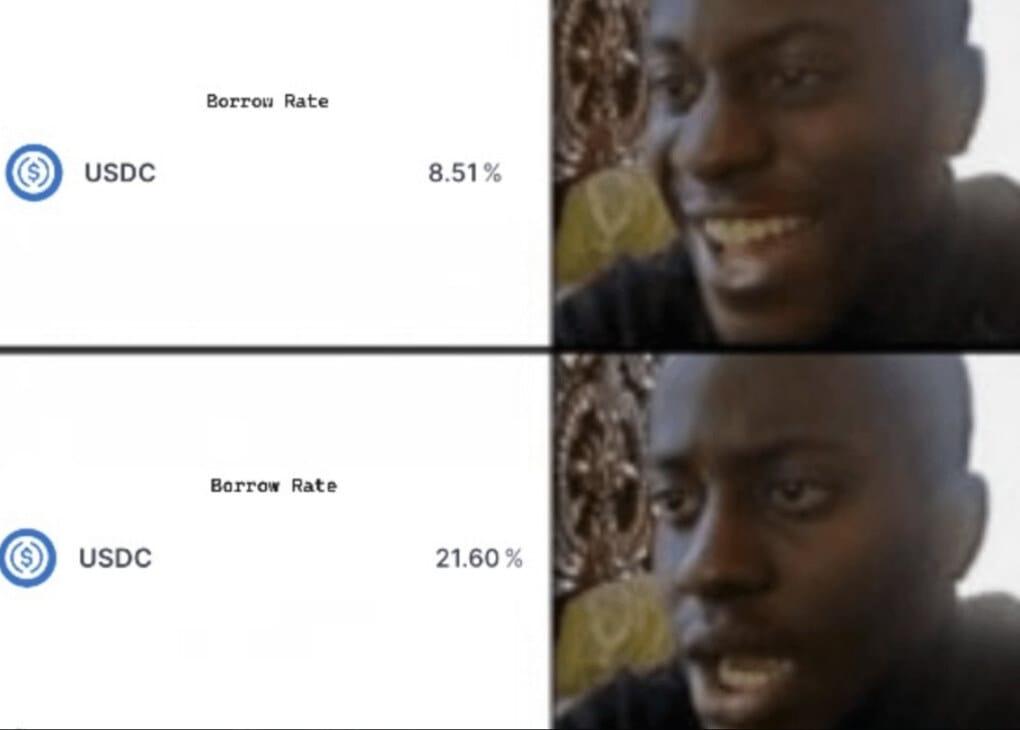

Considering a Loan? Go Fixed Rate

The unpredictability of rates in DeFi loans can quickly become problematic, particularly for those without a solid plan or sufficient knowledge.

Fortunately, this long-standing issue is getting fixed thanks to Term Labs. Additionally, the first Bomb Pot Auction is now underway, providing an excellent opportunity for those wishing to become a supplier and earn extra wstETH yield through a collaboration with Lido Finance.

Enjoy!

👀 DeFi insights.

The important bits.

GuildFi (Gaming) - Invested in bythen - read

Thales (DeFi) - Speed Markets reach ATH users and volume - read

Kyber (DEX) - Joins Mantle’s DeFi ecosystem - read

Mantle (L2) - 2.5M Ethena shards available for lockers - read

Clone Protocol (Cloned assets) - 1 week remains for 1.5x trade point multiplier - read

Protectorate (NFTfi) - Introducing Zaar - read

Mode Network (L2) - Giga bounties for developers announced - read

📰 DeFi news.

Even more important bits.

GBTC outflows remain low - read

Curve Finance weekly fees reach $1M - read

Lottery ticket sales in the USA reach ATH - read

Mog Coin brings clean water to Nigeria - read

Fed’s Barkin: “I am optimistic about keeping rates restrictive” - read

Jerome Powell doesn’t expect rate cuts until inflation is tamed - read

Franklin Templeton released Bitcoin Ordinals research paper - read

🫠 ICYMI.

Life gets busy so here’s what you’ve missed.

Top Eigen Layer Actively Validated Services (AVSs) to Watch

Podcast/DYOR

Grant and 563 are back for another episode of DYOR; this time, the gruesome twosome are going through the top Eigen Layer Actively Validated Services (AVSs) to watch.

Tune in on YouTube →

API3: The End of the Age of third-party Oracles

Research

API3 provides a new approach that is helping dApps save over 100 million dollars of would-be-lost revenue, which can likely come back to the users, and that's worth some attention.

🐥 Tweet of the day.

To save you doom scrolling.

This tweet from dirtydegen420 pretty much absolutely perfectly sums up this Friday in crypto.

🦍 And finally…

In closing, for those not yet attentive to the Base ecosystem, I recommend listening to this podcast featuring Jesse Pollak, who not only sheds light on Base but also elaborates on the broader vision for Ethereum's layer 2 solutions. I believe this is Solana season all over again, if not bigger.

Study the ecosystem airdrop effects (Friend Tech stimmy is coming, and it’s going to be massive).