🗞 Market commentary.

To you, the market participant, I wish you a very good morning, afternoon or evening

Well, this week hasn’t fallen short of bullish updates, rugs and, of course, market makers dumping their bags on us.

Coinbase, we said on Tuesday, is positioning itself quite handsomely to be the number 1 go-to place for normies and those who have stuck around in this bear market.

It seems as if Brian and the team have made a lot of the right decisions at the right time. Base launched and has become the new “Base” for on-chain micro caps, they’ve relaunched in Canada, host the Coca-Colas NFT collection and won NFA approval to list Bitcoin and Ethereum futures contracts, a first in the US.

Gensler must be seething right now, especially as Europe launches the first spot BTC ETF. Are we months, weeks or days away from Gensler being check-mated?

Whilst we wait for Gensler to make his move, trading bots continue to be the flavour of the month. Maestro continues to generate more fees than GMX and battles to stay ahead of Metamask. Yolo Nolo discord perps bot, and a team favourite, smashes past $1,100,000 in trading volume as all the cool kids in discord servers across the block duke it out for the #1 spot on the leader board whilst Unibots “Unibot X” went live yesterday.

Very very excited to see this wave of trading tools, bots and backend systems continue to innovate as this is an area of crypto that is likely to continue to grow and become a bull run essential.

On a side note, the FED will be speaking at Jackson Hole again on August 24th. Last time J Powell wiped off $1.25 trillion from the stock market in 8 minutes.

🤓 In today’s email.

Degen corner. BTC, Boom or BUST?!

DeFi insights. 11 degenerate defi insights

ICYMI. Podcast with Bumper Finance and research on Fuji Finance

Top Tweets. Is Bankless about to release a skincare range?

And finally. Gamblefi… that is all.

🔥 Degen corner.

The great BTC squeeze: Boom or Bust?

Bitcoin has been pretty boring as of late as we chop between $28,000 on days where CZ posts “4” and $31,000 on days fuelled by hopium, copium and (something else that rhymes) as the prospect of a $40,000 Bitcoin fades into a distant memory.

Flick on the Bollinger Bands and you’ll see we are coming into a volatility squeeze. This basically means, when the breakout happens… it’ll be violent regardless of direction.

And depending on which camp you’re in, this is either bullish accumulation, despite volume falling off a cliff as market participants went on vacation in Hamptons and the degenerates (that’s you and I) went on-chain for that 1000x.

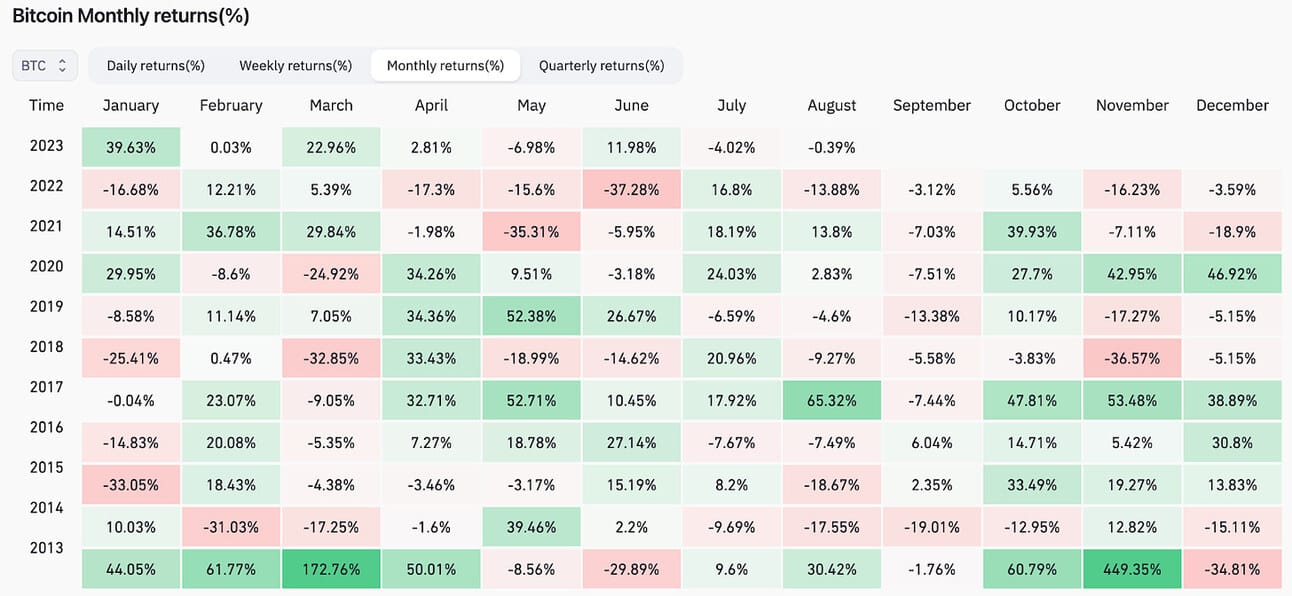

Or this is a bearish bleed-out ready for the global recession the media has been promising us and historically speaking… August is a pretty blasé month for Bitcoin. Plus Michael Burry and the politicians have all gone short on the macro markets.

SEC delays as the EU approves BTC ETF

Gensler is up to his old tricks as Swiss-based 21shares & Cathie Woods Ark Invest’s applications have been delayed another 21 days.

Whilst the SEC continues to play war games against crypto and its broader US-wide adoption, a London-based asset management firm, Jacobi Asset Management, launched the first Spot BTC ETF, debuting on the Euronext, Amsterdam stock exchange under the ticker BCOIN.

The BCOIN fund takes a green approach adding renewable energy certificate (REC) compared to T-bill, repurchase agreements, crypto-related equities and other investments that US-based ETF applications have included.

This should be a huge milestone for the King but Bitcoin, being Bitcoin, completely ignored the news as it continues this painful price action. All eyes are on the SEC as we await their response to Europe's first-mover advantage.

PS. Cancel your plans on Aug 31st & Sept 1st and sit yourself in front of your charts with a cuppa tea and wait for ETF news… unless it’s delayed… again… then continue with previously booked in plans.

👀 DeFi insights.

The important bits.

BNBChain - Teaser trailer for something happening 1st September - read

FireWallet - Waitlist for early access launched - read

Friend Tech - Gets a deep dive tweet by the official Base account - read

HMX - Secret revealed on how they sustain $650m trading volume vs $10m TVL - read

JPEG’d - Snapshot proposal for the community to choose a reimbursement option after the CRV hack - read

opBNB - stealth launched and opens up to infrastructure providers - read

PepperDEX - meme contest launching soon - read

Rainmaker - Celebrate recent partnership with BenQi & Vector Finance with an airdrop content - read

Savvy DeFi - jUSDC goes live on Savvy - read

Thales - Launch “Tales of Thales: Infinity Hotel” - read

HyperLiquid - Lists SEI perps quicker than Binance - read

📰 DeFi news.

Even more important bits.

EnsoFinance introduces the world's first DeFi intent-based API giving devs the tools to execute and fetch relevant metadata - read

Shibarium goes live on mainnet whilst Shytoshi, Shib Dev, announces over $1.7M+ ETH lost when bridging over - read

Tradfi trader Tom Lee speculates $150,000 BTC if the BTC ETFs are approved - read

Valkyrie join the race and file an ETH Futures ETF bringing the current total to 16 active applications - read

🫠 ICYMI.

Life gets busy so here’s what you’ve missed.

Podcast: Bumper Finance | Protection Against Market Pullbacks

Listen & Watch.

Jedi had a deep dive discussion with Gareth one of the founders from Bumper Finance to chat about an innovative approach to how you can protect your assets from downside volatility in the crypto markets.

Fuji Finance: A Step-by-Step Guide

Research.

Taking a crypto loan is straightforward; you deposit collateral and receive the required capital. However, managing your debt positions, including finding and optimizing for the best interest rates, is far from simple.

🐥 Top tweets.

To save you doom scrolling.

Kevin_Kelly_II, history doesn’t repeat… but it often rhymes

0xSisyphus, on-chain degens having fun then we pivot to poker nights

danblocmates, love ‘em or hate ‘em they do have the softest skin in crypto

🦍 And finally…

The first wave of gamblefi was pretty much a dud. I remember talking to projects at Solana breakpoint last year and they had a good idea just the wrong execution as they had web2 tradfi mindsets.

This current era of gamblefi has done well, imo, because they were launched by devs and teams who live in the trenches. A narrative that we are all keeping a close eye on across all chains.

🤝 A final word.

A quick word from our super awesome sponsors who help us make this all possible...

Discover how your skills could power the next generation of web3 and blockchain technology. Your next career move could be one you never imagined. Start your search today at Web3nomads.jobs.