GM legends and happy 4th July,

Whether you’re celebrating or not, Bitcoin tapped $31,000 and Ethereum is eyeing up $2,000, as NFT doom and gloom hits our favourite PFP collections whilst dino coins start moonshooting… What the DeFi is going on this week?!

Continuing from where we left off last week, we take a dive into the OP stack vs Arbitrum Orbit and who’s positioning themselves best for the next bull run.

PS… OP, Aptos and APE are all having hefty unlocks this month.

Need to know.

If you’ve only got 2 minutes.

The big story.

🔴🔵 OP stack vs Arb Orbit: and the winner is…

DeFi insights.

🖼 Swell Network airdrop part 2 coming soon

📅 Token unlock: OP, Aptos and Apecoin, largest in July

🫠 GM degen podcast: forks with airdrops, NFT gloom and biggest winners

In the news.

🐮 Nasdaq names Coinbase as “surveillance partner”

🐻 Hong Kong creates the “Web3 Development Task Force”

👨🏻💼 What the FED?! FOMC minutes Wednesday 5th

Plus Twitter reads from @OuroResearch, @krugermacro and @Loudround_!

🔥 The big story.

To make you think.

🔴🔵 OP stack vs Arb Orbit: and the winner is…

The battle for the OG Layer 2 crown has quietly been brewing and it’s about to get real spicy real quick.

Not just because the EIP-4844 (Cancun upgrade) is happening this year.

But because Optimism has its OP stack and Arbitrum has its layer 3 builder Orbit.

Let’s take a look at these in a head-to-head battle as OP depositors continues to climb.

Dune Dashboard | Looks like depositors know something…

Setting the Scene

Competitor Number 1: OP Collective

Optimism created the OP Stack, an open-sourced code stack for simplifying and creating permissionless layer 2s with the Modular Superchain Future in mind.

Competitor Number 2: Offchain Labs

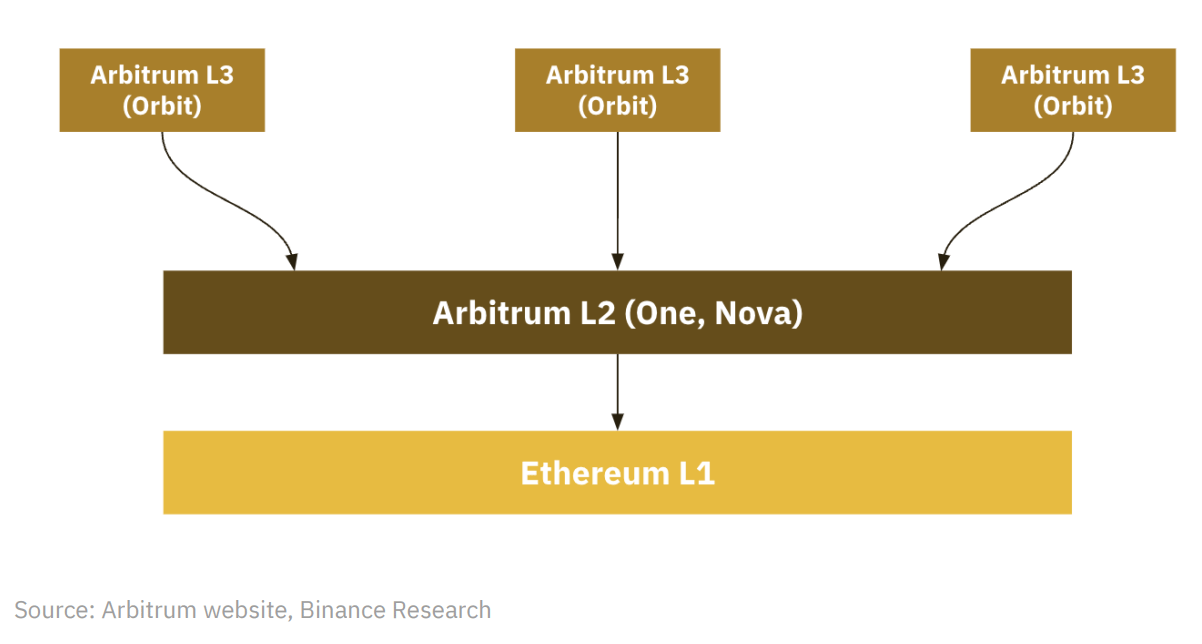

Better known for the most popular layer 2 Arbitrum. Alongside the $ARB airdrop, Offchain Labs released Arbitrum Orbit, allowing developers to permissionless-ly launch layer 3s and leverage Arbitrum's tech to build in the ecosystem.

Arbitrum’s story so far: Arbitrum One → Arbitrum Nova → Arbitrum Nitro → Arbitrum Orbit

The Vision

Similar vision, two different paths

Optimism and Arbitrum are both on a mission to improve Ethereum’s scalability whilst also looking to transition to a more modular blockchain framework.

Optimism wants to unlock and create a modular future, (splitting consensus, execution and data availability layers across different chains) which simply means “doing a few things very well and outsourcing the rest.”

This “modularity” gets unlocked with the Superchain, a collective of layer 2s sharing the same security, bridging, decentralized governance, upgrades, and a communication layer by using the OP stack.

Arbitrum’s vision is to unlock the power of decentralisation and leverage its governance token. The release of Arbitrum Orbit allows for a move away from a monolithic approach to a more modular and component-based framework.

Orbit is to Arbitrum what Arbitrum is to Ethereum… a roll-up. It’s the development framework for creating and deploying permissionless layer 3s on top of the Arbitrum mainnet.

The Comparison

Same same, but different. It feels and looks the same but different at the same time. OP’s super chains vs Orbits app chain.

But in this quest for the crown of OG layer 2… who’s doing it better?

The “Over Powered Superchain Side Chain” or the “Rolled up roll up or a roll-up?”

The two important areas we want to focus on are “usability” and “token value accrual” because too many times “cool tech” doesn’t lead to effective pumpamentals, which is 95% of the magic… and what we as investors want.

Usability

Optimism has recruited and acquired some of the industry's key figureheads, to not just build using the code but to also aid in the development of the stack itself. Coinbase is building Base (and helping Eth devs with EIP-4844), CZ is building the BSC layer 2 opBNB, Worldcoin is developing WorldID and options protocol Aevo & the NFT layer 2 Zoranetwork using the stack.

Despite the almost chain-crushing governance slip-up, key network employees leaving and a token unlock set to make a set few individuals extremely internet-rich, Arbitrum’s Orbit is slowly beginning to pick up traction.

Syndr, a cross-margined derivatives exchange, recently announced Syndr Chain, powered by Orbit with the objective to onboard another 60m users into DeFi.

Pumpability

We’re all innit for the tech, right?! The financial gain is just a bonus, yeah?!

From a value accrual perspective, OP might have shot themselves in the foot. On the face of it, the OP Superchain will become its own ecosystem, with each layer 2 having its own token and fee structure staying within.

Thus making the token price go up for OP pretty slim. After all… it’s just a governance token, right?!

Coinbase, at the moment, will be delegating a portion of fees back to the OP collective but whether this gets passed on to OP token holders is another story.

In this case… Optimism gets a big fat L.

If and/or when the Superchain becomes a real thing, that might be a narrative trade that plays out. We saw at the start of this post the number of bridgers has increased dramatically whilst the below shows that the active daily users are steadily increasing for OP and dropping off for Arbitrum.

Arb, Eth & OP active address | Nansen

Orbit, on the other hand, will be using the $ARB token to pay fees which will be routed to Arbitrum sequencers. A unique and novel approach that allows revenue to be generated from open-sourcing code stacks.

However, if no one is building or using it then it’s an approach that just sounded good on paper. Given that Orbit is built on Nitro I wouldn’t be surprised if we see a wave of Trading, NFT or Gaming projects being released.

After all, apart from GMX and a few other DeFi blue chips, the Arbitrum ecosystem has been flooded with NFTs and gaming such as the MAGIC ecosystem and the Beacon.

In theory, if the Orbit ecosystem gets used and liquidity becomes as phat and juicy as Arbitrum then $ARB token holders might be in for positive price movement… but in the future… the very distant future.

Our take.

Honestly, it looks as if Optimism is positioning itself to crush the next bull run. They’ve got usability, narrative and some of the industry’s giga brains, god-tier icons and tech. It also helps that those building using the stack are all somehow connected.

Arbitrum feels as if it’s stuck in the “loading… please wait” category and we’ll keep an eye out on the next wave of developers using Orbit.

With Ethereum’s Cancun update coming, Ethereum ETF hype in the news and “insider connections” connecting the ecosystem together… the narrative for layer 2s, roll-ups and a modular future has never been spicier. Wen?! Probably the end of the year.

PS. You can read more about it in last week’s article here.

Favourite part of the newsletter?

👀 DeFi insights.

Project updates, governance reports and industry secrets.

The World of DeFi

dYdX - Public testnet goes live July 5 at 5PM UTC. (Twitter)

Eigenlayer - Soon to be increasing restaking capacity for LST and native restaking. (Twitter)

Euler - Euler V2 (Twitter)

Fuji Finance - Announces partnership with Zoth. (Twitter)

GMX - Everything you need to know about V2. (Twitter)

Hyperliquid - Launch open interest rewards campaign July 4-11. (Twitter)

Protectorate Protocol - Event Horizon Dutch auction update. (Twitter)

Swell Network - Voyage airdrop part 2 is coming soon as the team recaps part 1. (Twitter)

Unibot - Partners with Dopex bringing option and scalp trading to users. (Twitter)

Unlocks - Optimism, Apecoin and Aptos lead the way with large unlocks in July. (Token Unlock)

Governance Updates

AzukiDAO - Proposal passed to hire a Lawyer and help the community reclaim the 20000ETH from Zagabond (Snapshot)

Camelot - Proposal submitted to the Arbitrum DAO for a grant of 12m ARB tokens to be distributed as liquidity and incentives over 6 (Arbitrum Foundation)

UniSwap - ARB distribution proposal poll In voting temp checking 4 different proposals. (Snapshot)

🫠 GM degen.

The latest GM degen podcast.

We all love an airdrop thread right?! Tune in to episode 11 to find out why forks using airdrops is pointless and a look at all this NFT drama.

🗞 In the news.

The important bits.

Bored Apes are going to Zero as the price continues to crash amidst the great NFT sell-off. (The Block)

Crypto ATM “Bitcoin Depot” launches on the Nasdaq. (Decrypt)

Gemini spent $100m in legal fees so far against DCG in the latest open letter from the Winklevoss Twins. (Twitter)

Hong Kong creates the “Web3 Development Task Force” in an attempt to become the hub for Web3 in Asia, featuring Animoca Brands Chief, Yat Siu. (Coindesk)

Nasdaq names Coinbase as surveillance partner in the latest refiling for Blackrock’s spot BTC ETF. (The Block)

Revolut delists Solana, Cardano and Polygon after security fears from the SEC. (Decrypt)

VCs become bullish on Infrastructure as NFT and gaming investments begin to dwindle according to The Block research. (The Block)

👨🏻💼 What the FED?!

Here’s what’s coming this week in the FED.

🐥 Twitter reads.

In case you missed it.

@OuroResearch TLDR their research report on Frax Finance.

@krugermacro takes a look at the constant calls for a recession.

@Loudround_ shares lessons from the last bull run.

And on that note, thanks for reading, catcha apes in the next edition!

blocmates team 🫡

🤝 A final word.

A quick word from our super awesome sponsors who help us make this all possible...

Discover how your skills could power the next generation of web3 and blockchain technology. Your next career move could be one you never imagined. Start your search today at Web3nomads.jobs.