GM Legends,

The SEC has been busy this week attacking Binance, then Coinbase then Gary Gensler pontificating on CNBC as fake news had CZ gunned down whilst crypto Twitter unites together.

Gary has gone about this completely wrong; today we recap what’s been happening whilst Arbitrum has its first network outage due to “no gas money.”

Need to know.

If you’ve only got 2 minutes.

The big story.

🧐 Gary’s got it all wrong and here's why.

DeFi insights.

🖼 Pepes Game releases “How the flywheel works”

📅 Swell Networks “Voyage” airdrop bonus update

🫠 GM degen podcast: Mike gives Brian & baldness a thumbs up

In the news.

🐮 Messari CEO Praises Republican Crypto Bill

🐻 Arbitrum network goes down, ran out of gas money

👨🏻💼 What the FED?! Wednesday June 14th = FOMC!

Plus Twitter reads from @rektdiomedes, @nic__carter and @Prithvir!

🔥 The big story.

To make you think.

🧐 Gary’s got it all wrong and here's why.

At first, it looked net positive when Gensler was put in charge of the SEC.

After all, he taught blockchain at MIT, co-wrote the 2018 “blockchain technology has a real potential to be a catalyst for change in the world of finance” paper and even shilled Algroand to his students.

So how did this blockchain professor become a digital currency-hating bear?

Because right now, I am a little confused as to why Gensler wants to nuke the crypto industry as the 2018 paper concluded that “blockchain technology held promise to directly replace legacy infrastructure and financial services or catalyze industry change.”

Crypto Underfire… The Allegations

It started off as a boring week but then the SEC dropped 2 major bombshells targeting Binance and Coinbase.

The allegations are simple. Acting, profiting and soliciting as an unregistered securities exchange offering unregistered securities and the comingling of funds (but not like FTX did), and the list goes on.

A lot of the same from previous legal letters sent but what blindsided the markets was the announcement of allegations against 19+ tokens spread across both exchanges including SOL, SAND, MATIC, MANA and ironically… ALGO.

Numb. But angry.

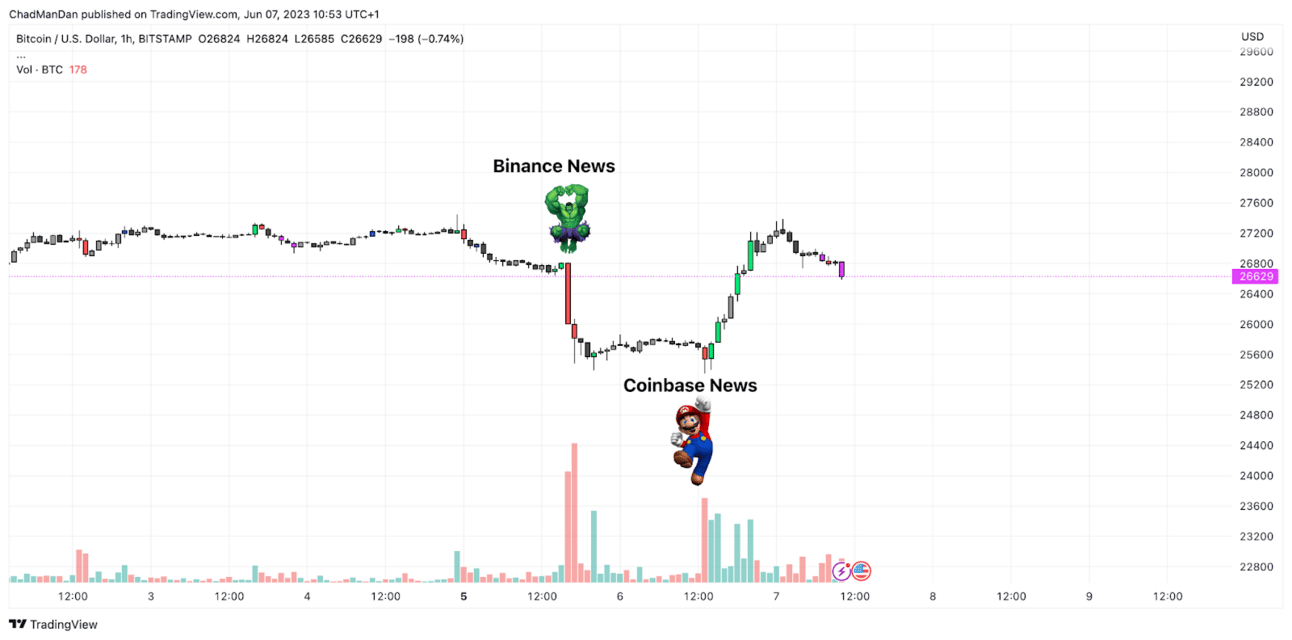

That's how I would describe how the market reacted. Liquidations were hit in both directions as the Binance news sent the markets lower, wiping out leverage longs. Whilst Coinbase being sued saw the markets pump…

Yay… Mario!

Binance & Coinbase Respond

CZ posts the international sign of FUD.

Whilst Coinbase publicises the facts because numbers don’t lie.

He got it so wrong…

How can 1 man get it so wrong?

The SEC’s mission is simple. To protect investors. Maintain fair, orderly, and efficient markets and facilitate capital formation away from market manipulators, manipulation and evildoers.

And yet they failed to protect the people from 3 of the biggest financial disasters to hit crypto. Binance and Coinbase should have been the last of their worries.

Whilst trying to “protect the people” Gensler’s crusade has financially crippled investors, wasted American tax dollars and united crypto Twitter.

But most of all he will have to embarrassingly stand by his claims in a court of law. And we all remember how that went the first time around?!

… and ignored Coinbases pleas

Coinbase has been pleading with the SEC to give guidance, regulation and a rule book to follow.

All of which have fallen on deaf ears.

And after the bank run earlier in the year the Fed has been gearing up for FED NOW, an instant payment infrastructure created by… the FED.

I see what’s going on here…

Our Take

There are still a lot of questions that need to be answered by both the SEC and the big exchanges.

When will regulation come into play?

What will it look like?

And how can we properly protect investors?

But on the face of it, Binance and Coinbase look like they are in a strong position.

Binance just liquidated over $170m (to pay for bills??) and Brian, well he’s just won crypto Twitter over.

Stifling innovation is a crime as more participants enter the race to become the global playground for Web3 & blockchain technology as we saw the bull run pump the markets to a $3TN market cap.

A major “whoops” mistake if the disconnect continues.

Give us your feedback

👀 DeFi insights.

Project updates, governance reports and industry secrets.

The World of DeFi

Ape WorX - In preparation for the Chaos Net beta, the team has released Ape Pay an automated payment tool for crypto. (Twitter)

Arbitrum - 4,000,000 $ARB tokens distributed to the DAOs. (Twitter)

Circle - MPI license in Singapore acquired allowing for digital payment token services alongside cross-border and domestic money transfer services. (Twitter)

Sparta DEX - Welcome Parallax Finance to the Spartan alliance. (Twitter)

Optimism - The Bedrock upgrade was a success, improving the OP stack for developers. (Twitter)

Pepes Game - Release details on how the flywheel works. (Twitter)

Perpy Finance - Weekly recap #19 including NFT mint, new intern and Mafia Nuts white list spots. (Twitter)

Savvy DeFi - Release IFO information ahead of Arbitrum launch on July 13th. (Twitter)

Swell Network - Voyage airdrop bonus update, earn more pearls by minting swETH. (Twitter)

Trader Joe - Lvl’s up with a partnership with Level Finance. (Twitter)

J.Page - A zero-fee NFT marketplace featured on Wen Llamas AMA. Here’s everything you missed including the beta release on June 9th. (Twitter)

unshETH - Hit the highest, >$2m, single-day arbitrage volume after adding Swell Network and Ankr staking. (Twitter)

Governance Updates

AAVE - “GHO mainnet launch” proposal is in the discussion phases on the Aave forums. (Governance)

Spool - Proposal passed to welcome their first 3rd party Risk Model Provider, Solity Network, allowing Spool Smart Vaults to be leveraged. (Twitter)

🫠 GM degen.

The latest GM degen podcast.

And no… when we say the battle of the baldys we don’t mean the bald crypto punks! Mike gives Brian and his bald head a thumbs up as he rallies the troops!

🗞 In the news.

The important bits.

Arbitrum goes down after running out of gas money, highlighting the chain’s single point of failure. (DL News)

Binance redirects $12BN to companies owned by CZ, according to the SEC. (Coindesk)

“We tried to register!” says Robinhood lawyers in a testimony put forward to the House of Crypto. (Coindesk)

Messari CEO praises Republican Crypto Bill's comments that it is a “10x improvement” as its drafts a pathway to compliance. (Cointelegraph)

Congress to respond to SEC lawsuits as US Lawmakers issue a warning to Gary. (DailyHodl)

👨🏻💼 What the FED?!

A blackout of Fed speakers this week leading into next week’s FOMC press conference with a 70% of keeping interest rates the same. (Fed Watch)

Tuesday - US CPI

Wednesday - US PPI and FOMC Economic Projections, FOMC statement & FOMC press conference

Thursday - US Retail sales & unemployment claims, EU ECB press conference

🐥 Twitter reads.

In case you missed it.

@rektdiomedes, we’ve got some funny-looking enemies in crypto right now.

@nic__carter looks at why the Bitcoin maxis were celebrating.

@Prithvir gives you some homework for the weekend.

And on that note, thanks for reading, catcha apes in the next edition!

blocmates team 🫡

🤝 A final word.

A quick word from our super awesome sponsors who help us make this all possible...

Discover how your skills could power the next generation of web3 and blockchain technology. Your next career move could be one you never imagined. Start your search today at Web3nomads.jobs.

Thursday