YEET.com has been doing some cool stuff lately in the crypto casino space, so we’re giving it a shout-out for anyone who’s been meaning to check it out.

They’ve been putting out a bunch of fun, crypto-themed games with plenty more coming. There’s a mix of quick spins and deeper plays, so you can poke around and see what you like.

It’s easy to jump in. Just hit the link, sign up and have a look around.

Worth exploring if you haven’t already. And as always, gamble responsibly.

GM!

It’s been a wild day and my phone has been buzzing non-stop with updates from CT since morning. If you’ve notifications turned on like me, you already know what I’m talking about.

First things first, a new report from Anthropic claims, “Hey, btw, AI can now exploit smart contracts like a OG black-hat hacker, and sometimes better.”

Anthropic tested models like Claude Opus 4.5 and Sonnet 4.5 inside a simulated blockchain environment, and the results were… unsettling. AI successfully exploited 17 out of 34 test contracts deployed after March 2025, “stealing” $4.5 million in mock funds.

Across a wider dataset of older contracts, the bots captured a simulated $550 million, and even uncovered brand new zero-day bugs worth thousands in potential real-world damage.

Anthropic basically warned that more than half of the 2025 hacks could have been executed by AI alone, and that exploit revenue is doubling every 1.3 months. The silver lining: the same AI can also patch vulnerabilities… if developers actually start using it for defense.

Meanwhile, Grayscale Research has decided it’s time to fight the doom-and-gloom narratives. The firm says all the panicking about Bitcoin entering a long winter is misplaced, in fact, they expect BTC to hit new all-time highs in 2026.

Their argument: this market hasn’t had the typical parabolic madness that precedes major reversals, institutional flows now dwarf retail speculation, and macro conditions (potential rate cuts, US crypto legislation) still offer tailwinds.

Tom Lee echoed the sentiment, saying fundamentals look better than prices, and reiterated his call for a new ATH by January.

While analysts are manifesting ATHs, Bitcoin miners are living a very different reality. According to TheMinerMag, miners have now entered their harshest profitability environment ever.

Hashprice has slid to around $35/PH/s, far below the median hashcost of ~$44/PH/s for public miners. Break-even is vanishing, machine payback periods have crossed 1,000 days, and debt issuance is becoming more expensive.

Some miners, like CleanSpark, are rapidly de-leveraging to survive, but sector-wide, the stress is real, and Q4 debt-raising seems to be on track to break records. It’s turning into a sorting phase, where only the most efficient operators make it out clean.

And finally, prediction-market giant Kalshi is stepping directly into the onchain arena, not just dipping a toe, but tokenizing thousands of its markets on Solana.

I don’t know about you, but this is a clear move to compete with Polymarket, which has been thriving on Polygon globally.

November was the biggest month ever for both platforms, and with the CFTC now giving Polymarket a path back into the US, the competitive space is heating up fast.

Kalshi is also partnering with Jupiter and DFlow to bridge liquidity, and introducing “Builder Codes” so anyone can build apps on top of its markets and earn fees.

Bang on!

👇 And if you haven’t yet, hit subscribe below 👇

The important bits.

Stage 2 of Kyan’s trading competition is now live, details here.

Magic Labs integrates Newton Protocol for its 50 million wallets and 200k developers, details here.

Plasma unpacks the key trends, developments, and data shaping the stablecoin industry, read here.

Neutrl’s epoch 3 yield distribution is now live. sNUSD is earning 20.5% APY, details here.

USDT0 expands to Mantle. You can move it on Stargate, 1:1 rate with no fees or slippage, read here.

QFEX wants to bring fairness to TradFi markets, here’s how.

Lenders get real demand and real yields on HypurrFi, details here.

edgeX drops details w.r.t. its pre-TGE contribution program, read here.

Nado reaches a new all-time high of $10 million in TVL during its private alpha phase, details here.

Jumper registers $2.05 billion in volume in November, read here.

Even more important bits.

US Federal Reserve officially ends quantitative tightening, read here.

FDIC set to unveil GENIUS Act rulemaking framework later this month, read here.

Vanguard to allow clients to trade crypto-exposed funds, including BTC, XRP and SOL, starting this week, read here.

Yearn retrieves $2.4 million after an exploit tied to arithmetic validation flaw, read here.

First-ever Chainlink ETF to launch Tuesday following approval of Grayscale’s LINK conversion, read here.

Charts and stats of the day.

BTC onchain traders hit record pain zone, chart here.

Coins grabbing the most attention based on social data, chart here.

Today’s bulletin:

Our complete guide to Neutrl:

Telemetry data of the day.

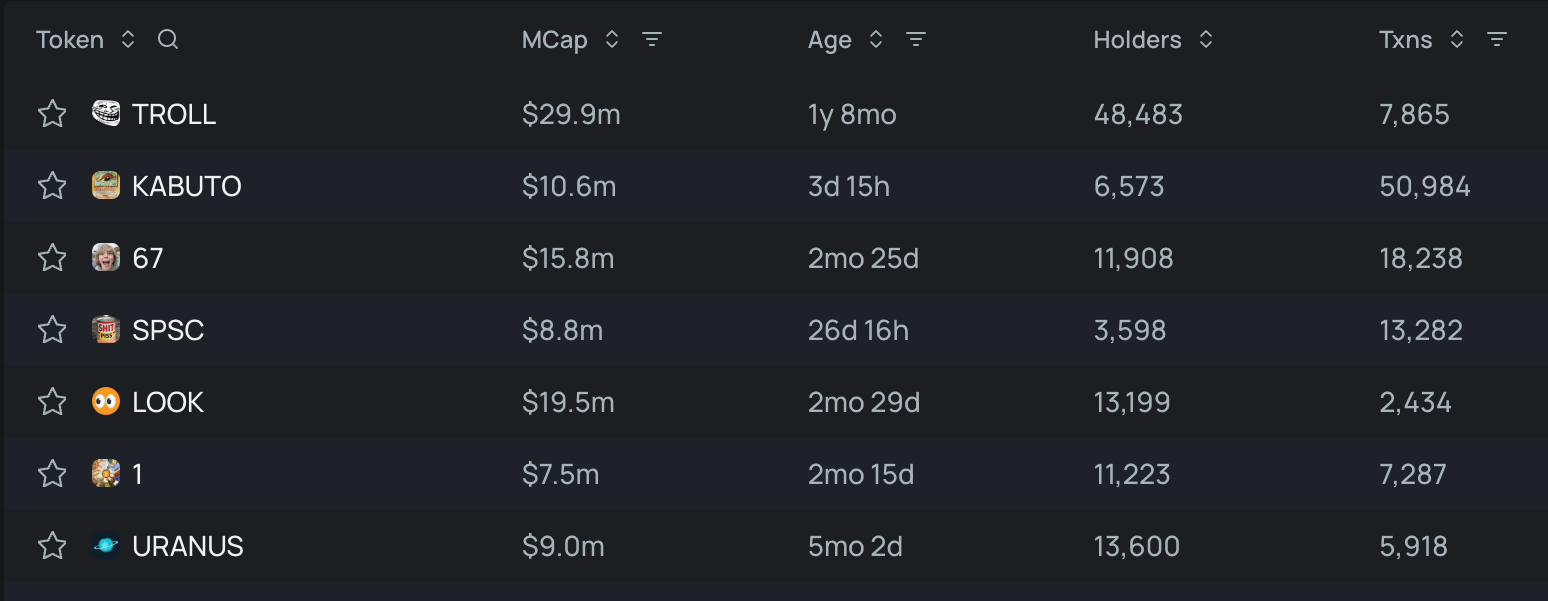

Top trending tokens for the last 24h:

If you want to access more of this type of data and trade freshly graduated tokens on PumpFun or Bonk, visit Telemetry here (it’s free).

If you’ve been following us on Twitter, you’d know that we have been keeping track of Saga over the last couple of months.

Well, things have gotten 10x more interesting of late. Before we get into the nuances, here’s a quick TLDR first:

Saga is an infra project that helps apps launch their own L1 protocols called Chainlets. Its vision is to allow apps to achieve infinite horizontal scalability by owning their own Chainlets.

Instead of fighting congestion on one monolithic chain, apps get their own L1 that plugs into a broader liquidity network, making everything from gaming to DeFi feel smoother, faster, and infinitely expandable.

Devs can access a full infra stack to launch their L1s without the usual headaches like security, validator architecture, foundational liquidity, and interoperability as consequences of their design choices.

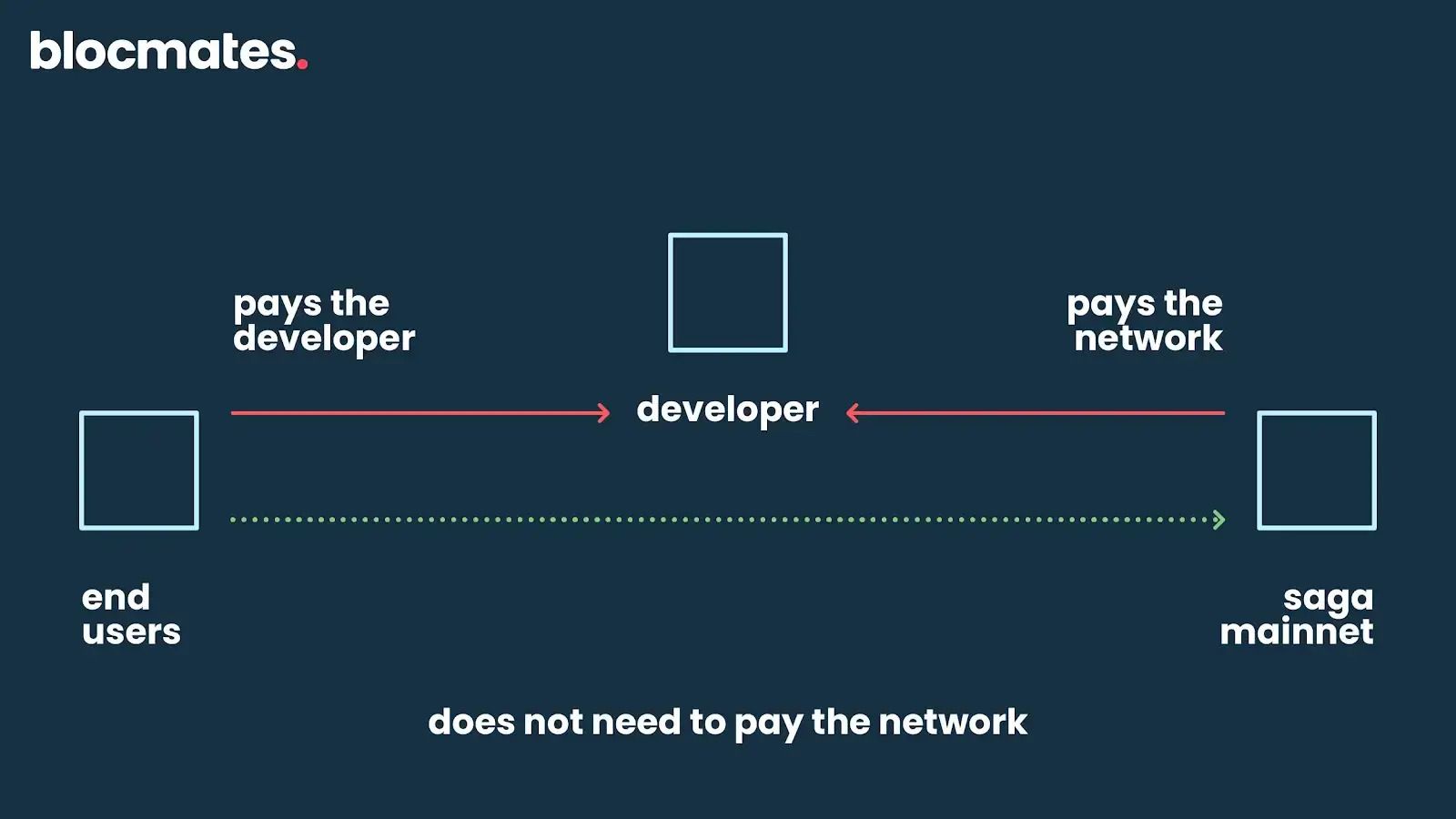

And the best part? You get the gasless experience.

Instead of end users forking out gas fees to the network, developers absorb all transaction costs, and users interact with Chainlets without paying fees to Saga.

This front-end flow means devs can experiment with monetization, opt for pay-per-use in any token of choice, enable subscriptions, or run freemiums, while the underlying infrastructure remains abstracted away from the end user.

Devs retain the collected fees in their own wallets, preserving the full value of their applications. On the back end, they “subscribe” to Chainlet capacity by depositing a fee bond in SAGA tokens.

DeFi on Saga is already heating up. Colt and Mustang, the project’s flagship protocols, went live on the network last week.

Colt is building a yield-bearing stablecoin system where users mint $D (1:1 to USDC) that auto-generates reserves to boost lending yields, already hitting $1.5 million minted.

Like the team says, every single $D token is fully backed with yield bearing tokens that directly drive growth back to the Saga DeFi ecosystem.

Mustang, a Liquity V2 adaptation, lets users mint the over-collateralized $MUST stablecoin against assets like ETH, tBTC, and SAGA, quickly climbing past $985k in total value locked.

Together, they’ve pushed roughly $1.9 million TVL in just a week since launch, showing how fast Saga’s flywheel spins once apps tap into its liquidity layer.

The ecosystem is gearing up for yet another launch in the near future, so I’d say keep tabs on what they’re cooking.

DeepNode AI, decentralized AI infrastructure platform.

ACORE AI, an AI platform focussing on embodied virtual agents.

To save you doom scrolling.

We’re attention sluts. PREACH!

It all feels kinda overwhelming at times. Yeah, I get it. Take my advice and stop doomscrolling for a day or two. Your braincells will thank you later.

Until then keep it light, keep it silly, and take it ezzz. We’ll get there slowly!

Edyme, Lavina 🫡