GM to the bulls and bulls only.

What a lovely god candle I woke up to today. Who could’ve guessed? Well, certainly anyone who read the last few newsletters and remained bullish as long as BTC chugged along above $95.5k.

Even though Printer Chief Powell once again refused to trim rates yesterday, leaving them steady at 4.5%, Bitcoin simply doesn’t care. Jeromer ‘too late’ Powell even hinted that there might be zero cuts this year, if the Fed doesn’t see a real need to do so. With that, the odds for June’s FOMC cuts declined to only 29%.

Still, with most of the globe shifting into easing mode, that’s hardly a market death sentence.

It seems like tariff chaos is steadily calming down, which is currently more important. Trump just finished a trade deal with the UK and says the China talks are also progressing nicely.

What’s either a death sentence or a true blessing is that ETH started outperforming Bitcoin, perhaps fueled by this week’s Pectra upgrade, which also sent ETH back into the deflationary zone.

Even if ETH doesn’t shoot up straight back to ATHs from here, I can see it happening sooner or later. The stablecoin narrative, fueled by the upcoming Stablecoin Act in the US, is a powerful one, and ETH is still the real home of DeFi.

Patience will still likely be required, but I’m definitely feeling optimistic.

👇 And if you haven’t yet, hit subscribe below 👇

The important bits.

Premia Blue releases a summary of their new products, read here

Tanssi explains how it plans to scale RWA infrastructure, check out the thread

Magic Newton partners with Kaito and announces rewards, join here

Genlayer partners with Atoma Network, launching the first trustless AI stack

AltitudeFi explains how they make crypto lending smarter, read here

Vana integrates with MAITRIX to bring stablecoins into AI data economy

SKALE reached 100m+ transaction in April, check out full statistics here

Ramen Finance opens the Beratrax presale, register here

Peapods Finance offers 58% APY on ETH volatility farming, vault available here

Kaito releases pre-TGE yap leaderboard for Magic Newton airdrop

Magic Newton fixes crypto UX with first verifiable agent, try it out here

Tari mining hash rate reached 10% of Monero’s, mine XTM here

Unit Protocol on Hyperliquid reached 3 billion USD volume

Resolv Labs releases new roadmap, read here

Even more important bits.

EU proposes tariffs on $95b of good it tariff talks with the US fail

OpenAI Hires Former Meta and Instacart Exec in Leadership Reshuffle

Ethereum Foundation allocates $32.65M in Q1 2025 funding

The Bank of England has cut its key interest rate by 25 basis points to 4.25%

Tump says tariff talks with the UK are good and comprehensive

Oregon signs SB167 into law, clarifying digital asset rules

Michael Saylor urges Saudi Arabia's Wealth Fund to invest heavily in Bitcoin

Coinbase to buy Deribit for $2.9B ($700M cash, 11M shares)

Charts and stats of the day.

Hey, if you like what we do here at blocmates in keeping you ahead of the crypto space, we have just launched another weekly newsletter that covers the latest news, tools, tricks and tips in AI.

It is basically blocmates for AI!

As a special welcome bonus, and a thank you, when you sign up, we will send you private access to the Big Machines telegram chat, which is filled with builders, founders, investors, and AI nerds.

Send the Big Machines main account a message on Twitter/X showing that you have subscribed, and we will send you the link.

XMRUSD 1W Kraken

We’ve featured Monero once before here, and it’s definitely worth including again here. Momentum has ramped since Trump won the day in November, and I can only imagine there have been some people frantically looking to hide their money as techtonic shifts in global trade and mass DOGE firings at the CIA, USAID and elsewhere began to kick in. The crypto crime cycle has only added fuel to this fire.

It’s an interesting chart, not least the 1000x we saw from January ‘16 to December ‘17, and the fact that it pico topped both of the previous cycles, almost at the same price. High timeframe structure is basically a giant Adam & Eve at this point. I’d be surprised if we conclude this cycle without new highs. Adding to mindshare potential is the leveraged security relationship with the new PoW chain Tari, covered yesterday in this newsletter.

If you’re looking to enter and the price is not pulling back, low-timeframe RSI alerts are a good way to go. Set them in Tradingview (can’t do it on the free one unfortunately) for when RSI crosses below 35 on the 30-minute timeframe. Give yourself a week or two to enter like this, accumulating a little bit on every dip. You may get a bigger pullback before that timeframe is up.

Come by the Lucky Luke Discord channel for comments, to roast m

y picks or to pump your own bags. All banter is welcome any time!

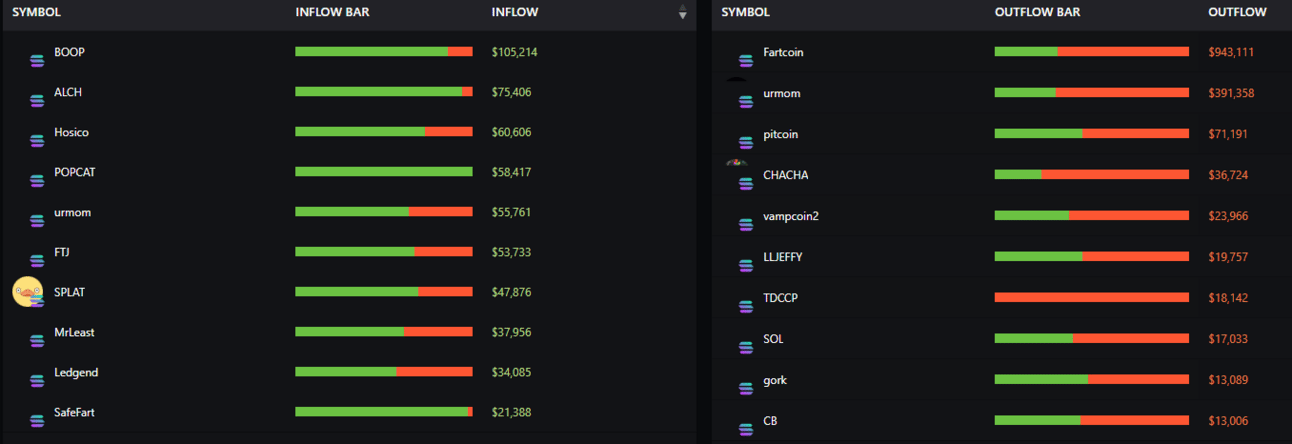

BOOP got pretty viral lately and it’s showing up in the Solana smart money movements. Next PumpFun?

Source: ChainEdge

Ethereum smart money movements got absolutely mogged. The moc/acc narrative takeover.

Source: ChainEdge

Wayfinder AI

Wayfinder is a very slick-looking omnichain AI agent protocol. Agents operate as "Shells," interacting with blockchain data, executing token swaps, doing cross-chain bridging, and smart contract deployment, all using natural language commands. There is multichain support for Ethereum, Solana, Base, and Cosmos, amongst other chains. Read the Wayfinder Paper for details.

The $PROMPT Token

$PROMPT is the utility and governance token for the protocol. There was a partnership with Kaito, through their ‘yap-to-earn’ program, to reward yappers with token allocations. The $PROMPT airdrop claim began on April 10 at TGE, but was paused when a bot named Yoink stole 119 ETH with an MEV exploit targeting Kaito’s portion.

This airdrop snafu produced quite a bit of FUD and sell pressure, all of which looks pretty much resolved today. The chart is looking mighty fine right about here. I am looking to buy any pullbacks down to the 0.30c area. My first target would be that VWAP level at 0.36, but momentum indicators are looking good (MACD, Awesome Oscillator), and a run all the way to the top of the range is within the realms of possibility.

Kuma (Berachain perpetual markets) - BGT rewards are now activated

To save you doom scrolling.

Inhale this hopium with the same vigor Raoul inhales his vapes. If this happens, we’re heading into wagmi land.

Speaking of Ethereum, charts look positive, but the main community members really need to stop doing shit like this.

stay safe homies,

Hix0n 🫡