GM, the show must go on.

Bitcoin is hovering around $85k, the fear and greed index is at its lowest level since June 2022, and more than half of the timeline is screaming that the cycle has ended.

While I think the cycle is almost certainly not over yet, treacherous weeks are ahead. While I highly doubt this cycle is over, the weeks ahead will be treacherous. From here? Hard to say—does BTC pump to retest the $90K breakdown, or nuke straight to $73-76K?

For this exact reason, you either stay on the defensive or try to get more defensive after this upcoming bounce and simply see what happens afterward. I would rather pay a little bit more for confirmation of BTC settling over $95k confidently, or stay safe and buy when lower levels are reached around $75k.

Meanwhile, we can watch the same bounce on the S&P 500, which is currently the real danger. It seems like the dump on SPX barely started, and in case it continues, crypto hardly holds up here even though it frontran a lot of damage already.

For now, everything is pretty overextended to the downside along with extremes reached in sentiment, so I wouldn't be surprised with relief into the start of March. Stay tuned; we’ll cover all of it as we go.

👇 And if you haven’t yet, hit subscribe below 👇

The important bits.

Pendle (DeFi) - Now live on Sonic

Core DAO (BTCFi) - Institutions are all-in on Core

mETH Protocol (LST) - Claim your cmETH rewards starting on Feb. 28

Peapods Finance (DeFi) - Coming to Sonic soon

Ionet (DePIN) - Partners with Fluence to decentralize the Internet's core infrastructure

Tanssi (DeFi) - Let’s Forkin’ Dance reward campaign: Second Island is now unlocked

Elixir (DeFi) - Announces partnership with asset manager Apollo Global

Even more important bits.

Ethereum Foundation donates $1.25m to support the legal defense of @TornadoCash's Pertsev

Texas Bitcoin Reserve bill passes the the senate floor

President Trump to close over 120 IRS tax offices nationwide

FBI confirms North Korea is responsible for the $1.5 billion Bybit crypto hack

Berachain announces new CTO position, Paul O'Leary

House Democrats reportedly set to introduce the MEME Act

Charts and stats of the day.

Coinbase chart hits very important bottom-level

Whales are panic-selling ETH

Pumpfun activity is trending to zero with speed

13,000 BTC worth $1 billion has been withdrawn from Bitfinex and Coinbase

Crypto taxes? Absolute pain.

Sifting through receipts, crunching numbers — it's a yearly ritual of suffering. Throw crypto into the mix, and it’s full-blown chaos.

Now you’re juggling transactions across wallets, flipping between CEXes and DEXes, and wondering if that airdrop was a win or just a taxable headache. And let’s not even start on staking rewards…

Well, it doesn’t necessarily have to suck.

Crypto Tax Calculator is built for degens like you. With over 1000+ integrations, a custom shitcoin pricing oracle, and the superpower to handle your on-chain terror.

You can either generate reports your accountant will love or directly file ‘em yourself.

Snag 20% off your first year. Your accountant — and sanity — will thank you.

USDT.D+USDC.D - Stablecoin Dominance - a cycle roadmap

A lot of people chart Bitcoin dominance, but I find stablecoin dominance (chart) is more interesting. As in tradfi, when the dollar index (DXY) goes up, it is sucks liquidity out the market, and risk assets usually do badly.

This is even more reliable in crypto. When stablecoin dominance (relative $ market share, in green above) is pumping, Bitcoin (in faded orange) and everything else goes down like a homesick mole.

We’ve seen a dominance downtrend since the FTX collapse - it drained a lot of liquidity out of crypto ex-Bitcoin. Arguably meme rugs have too. If a new stablecoin uptrend begins, it doesn’t necessarily mean it’s over - see last cycle’s uptrend above. With a new stablecoin-friendly admin in the US, dominance may go up. It is worth keeping an eye out for downside reversals in this metric though, as they correlate nearly 100% with BTC uptrends, which in turn precede the big altcoin bull runs.

Come by the Lucky Luke Discord channel for comments, to roast my picks or to pump your own bags. All banter is welcome any time!

AI mindshare falls sharply, but still at 32%.

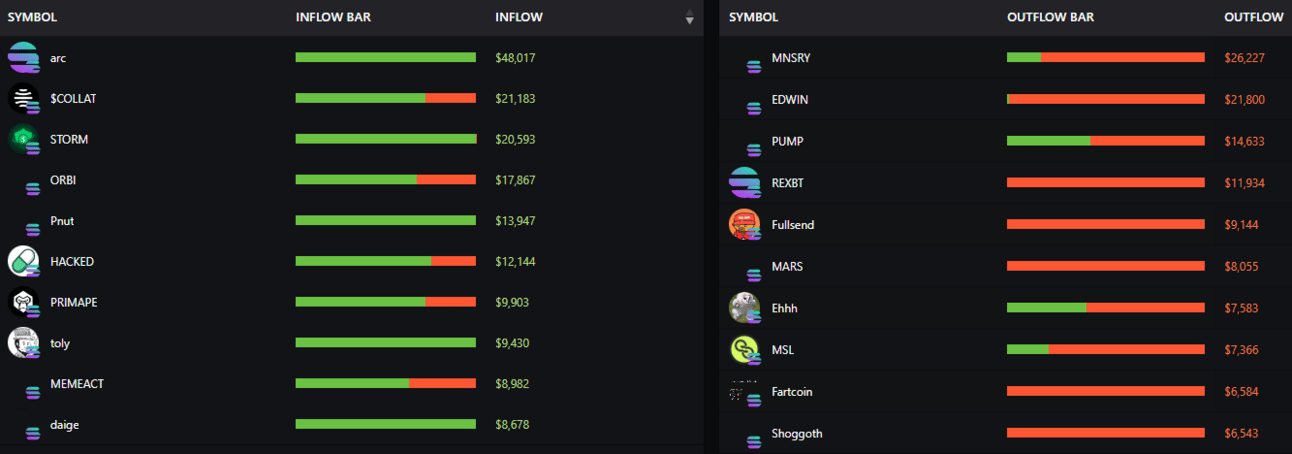

Smart-money movements on Solana.

Source: ChainEdge

Smart-money movements on Ethereum.

Source: ChainEdge

It’s Buyback Season!

Maybe you noticed, maybe not, but after the memecoin scene basically died, there’s more and more chatter about authentic, revenue-generating protocols that also buy back their own tokens.

This narrative is not only exciting, it’s precisely what we all need to focus on going forward. There’s too little actual “investment” in crypto and too much gambling.

For starters, check out this list of the most interesting “buyback” projects. I’m not saying you should go ahead and buy all of them right now—this is not financial advice, after all—but make sure to keep tabs on them.

Maker

Curve Finance

Convex

Dinero

Berachain

Hyperliquid

Jupiter

Jito

Rollbit

Awaken Crypto (Crypto tax automation)

Boom (Sonic perpetual)

Orion (Real-time trading terminal)

Stability DAO (AI onchain asset manager)

AiFred (Avalanche AI agent)

BGT Market (Berachain market for BGT)

Polaris on Bera (AI framework on Berachain)

To save you doom scrolling.

Dropping the funny stuff today, here’s a chart to keep in mind along what we went through in today’s market commentary:

We just went through a rapid drawdown on crypto prices. The thing to keep in mind here is that it always takes time for things to heal after such price movements. There can be a rapid bounce, but after that, more painful chop awaits.

For me, the cure is farming HONEY/WBERA LP on Berachain to keep sane. As always, the most important thing isn’t buying the exact bottom, the key is to survive. Survive for as long as it takes.

Good luck everyone!

stay safe homies,

Hix0n 🫡