YEET.com has been doing some cool stuff lately in the crypto casino space, so we’re giving it a shout-out for anyone who’s been meaning to check it out.

They’ve been putting out a bunch of fun, crypto-themed games with plenty more coming. There’s a mix of quick spins and deeper plays, so you can poke around and see what you like.

It’s easy to jump in. Just hit the link, sign up and have a look around.

Worth exploring if you haven’t already. And as always, gamble responsibly.

GM!

It’s a fresh month, but the same lacklustre sentiment has been rolled forward. We’ve registered a 7% dip over the past day, and the market’s aggregate valuation has slipped below the $3 trillion mark. Holiday cheer, what holiday cheer?

Nevertheless, the weekend brought its share of action.

Starting with Elon, not because I planned to, but because he always seems to end up at the top of the list - perks of being the richest man in the world.

Musk sat down in an interview with Zerodha’s Nikhil Kamath, and instead of meme shilling, we got something very different: introspection.

He talked about DOGE not as a joke, but as a “side quest” that exposed how messy government payments actually are, missing codes, missing descriptions, missing accountability.

According to him, that lack of basic structure could be costing between $100–$200 billion a year. He also admitted philanthropy is hard, not because of money, but because most of the charity world rewards optics over impact.

And in true Musk fashion, he then pivoted to Bitcoin, calling it a “physics-based currency” grounded in raw energy, not regulation. He even threw in the Kardashev scale for good measure before jumping to a future where advanced AI makes money irrelevant.

Classic Elon arc.

Meanwhile, Vitalik resurfaced with a simple message to developers drowning in L2/L3 discourse: “You can just build on L1.” This was a quote to a post highlighting Ethereum’s “dirt cheap fees.”

He also nudged Zcash to avoid token-based governance, warning it could hurt privacy values if left to the whims of “the median token holder.”

Outside the personality drama, big institutions kept moving. Sony Bank is reportedly gearing up to launch a dollar-pegged stablecoin in the US by next year, likely for use across Sony’s games and anime ecosystem.

And over in Singapore, Ripple secured an expanded license from MAS, giving it more room to scale regulated payment services and push RLUSD and XRP across Asia-Pacific. Ripple called Singapore’s clarity “world-class,” and honestly, MAS just continues to run laps around most regulators.

That's not all. DeFi also served its weekly reminder that “audited” doesn’t always mean “invincible.” Yearn Finance’s yETH product was drained after an attacker managed to mint unlimited yETH and suck the entire pool dry in one swoop.

The exploit funnelled roughly 1,000 ETH (about $3 million) through Tornado Cash, with millions more wiped from associated Balancer pools. Yearn confirmed the incident but stressed that its V2 and V3 vaults are untouched.

👇 And if you haven’t yet, hit subscribe below 👇

The important bits.

XO market crosses $10 million in volume, details here.

You can use Kintsu’s sMON as collateral on Townsquare, read here.

Almanak tops the list of top DeFAI agents by AuM, details here.

QFEX drops updated docs, read here.

Nado surpasses $1 billion in cumulative volume, details here.

A new market for Neutrl's sNUSD is now live on Pendle, read here.

Even more important bits.

Chainalysis pushes back on Binance’s recent analysis of “illicit crypto exposure,” read here.

Hayes warns Tether’s Fed bet and gold–BTC shift could put USDT equity at risk, read here.

David Sacks says NYT misrepresented its probe into his White House AI/crypto role, read here.

Former Citi analyst pushes back on Hayes, says Tether insolvency “highly unlikely,” read here.

First spot Chainlink ETF expected this week, says ETF Store prez, read here.

Charts and stats of the day.

XRP futures OI drops, chart here.

US labor market shows weakness, chart here.

The November-December correlation, stats here.

ICYMI.

Today’s bulletin:

Telemetry data of the day.

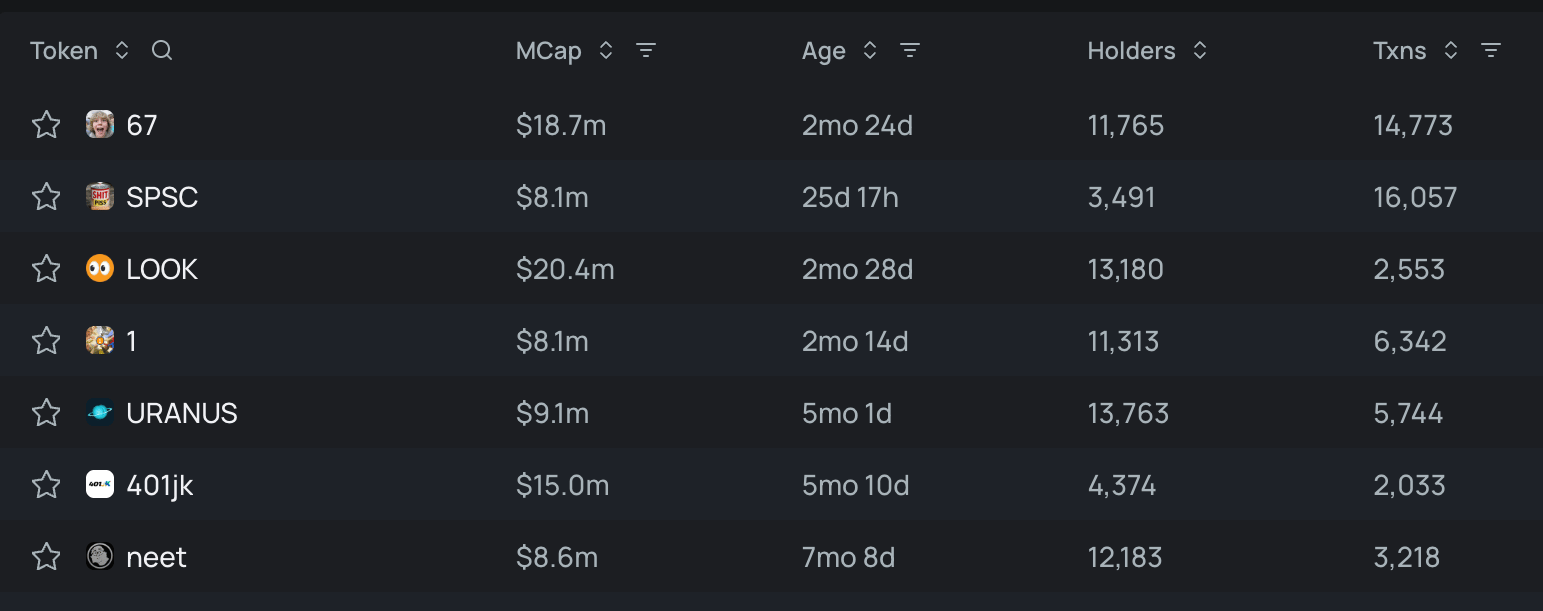

Top trending tokens for the last 24h:

If you want to access more of this type of data and trade freshly graduated tokens on PumpFun or Bonk, visit Telemetry here (it’s free).

Grass is one of the more interesting DePIN projects to pop off this cycle, a Solana-powered network that turns your unused internet bandwidth into an ethical, decentralized data engine for AI.

Instead of mining, renting GPUs, or storing files, you just run a lightweight app, and Grass aggregates that idle bandwidth into clean, verifiable datasets for AI labs and enterprises. Everything is onchain, privacy-preserving, and contributors earn $GRASS for powering the pipeline.

Where competitors like Rivalz or Dawn lean into compute and storage, Grass goes all-in on bandwidth as the fuel for AI data, a fast-growing niche usually dominated by centralized proxy farms with censorship and reliability issues.

Grass skips the heavy hardware, onboarding takes three clicks, runs quietly in the background, uses minimal energy, and never exposes personal data. It’s truly “set and forget,” but with real crypto rewards flowing back to users.

For everyday participants, that means passive $GRASS earnings (via points converting to tokens), and privacy-first architecture that anonymizes all traffic. It’s beginner-friendly, mission-aligned, and pushes AI data sourcing away from big corporate silos toward a community-owned model.

2025 has been a breakout year for Grass: The project rolled out multimodal data tools in January, hit 1.1M GB scraped daily by March, and held its first Token Holder Call in November.

Wynd Labs extended founder lockups to Feb 2026, the node count exploded, and a $10 million raise in October fuelled its evolution from simple bandwidth sharing to a full-blown multimodal data network.

And the revenue curve? It’s in its up-only phase. Grass hit $2.75 million in Q2, jumped 56% to $4.3 million in Q3, and is on track for a 197% rise to $12.8 million in Q4, all driven by enterprise data deals and reinvested straight into scaling the network.

Grant knew it all along. Don’t tell us we didn’t warn you about this earlier!

To save you doom scrolling.

The Fed has officially pulled its plug on QT today.

Historically, alts have outperformed BTC when QT hasn’t been active. A little more correction followed by a bounce for the rest of the month is what everyone is vouching for.

Bring it on!

Edyme, Lavina 🫡