Our friends at YEET.com have been on a tear lately, and to celebrate, they’re putting $500 back into the pockets of the blocmates readers every single week.

It’s super easy to get involved, just:

Sign up using the Link

Stay active

That’s it. You’re in the mix.

They’ve already released some pretty cool crypto-themed games, and with football (not soccer) season back, their upcoming sportsbook couldn’t be dropping at a better time.

So if you fancy a punt, go have a play. Just remember, as always: gamble responsibly.

GM!

Another day, another W for us Hyperliquid maxis.

Investment management firm VanEck is looking to file for a Hyperliquid spot staking ETF in the US + an ETP in Europe.

The firm also wants to allocate a percentage of the investment products’ net profits to HYPE buybacks.

We all know that HYPE doesn’t trade on any major US exchange at the minute. In hindsight, Hyperliquid stands out as an ETF candidate, giving our burger friends better access to the token.

Folks at VanEck believe that this move could also end up nudging exchanges to list the token. Net takeaway? Win-win.

The filing date isn’t locked in yet, but it sure as hell has got us all HYPEd.

In other news, US inflation numbers were out today.

CPI rose to 2.9%, core to 3.1% - both in line with expectations. We currently stand at the highest level since January 2025.

Plus, labour market continues to show weakness. Jobless claims notched up to 263,000 - worse than expected. The forecasted figure revolved around 235,000.

We’re currently standing around a 4-year high on this front, and it ain’t no joke.

BTC slipped below $114k briefly once the data was released. However, it quickly erased the losses and stabilized right after. At the minute, it’s back to trading around $114.5k.

With the FOMC meet scheduled for 16-17 Sept, next week’s gonna be a big one.

👇 And if you haven’t yet, hit subscribe below 👇

The important bits.

alUSD is now live on Pendle, with Almanak Points at a 1.25x multiplier (25% extra) for LPs & YT holders, read here

Giza partners with KelpDAO, read here

Users can use Jumper to swap any asset, from any chain, into APE on Solana, read here

LayerZero introduces OVault, details here

Saga’s staking rewards are moving to the community pool, read here

Even more important bits.

The Avalanche Foundation is in advanced talks to raise $1 billion for two US-based crypto treasury firms, read here

VanEck is preparing to file for a Hyperliquid (HYPE) spot staking ETF in the US and launch a HYPE ETP in Europe, read here

Brian Quintenz claims Tyler Winklevoss lobbied Trump to stall his CFTC chair nomination, read here

MegaETH is partnering with Lombard Finance to bring Bitcoin to MegaETH, read here

Ledger drops enterprise mobile app, read here

Polygon rolls out hardfork to fend transaction delays, read here

Meteora’s TGE is slated for October, read here

Charts and stats of the day.

Institutions are stacking ETH, stats here

Audited DeFi projects saw $3.3 billion+ in losses between '20-'25, chart here

Saylor’s Strategy now holds 3% of BTC’s total supply, chart here

Solana’s TVL reaches new ATH, chart here

Phygitals registers $20,000,000+ in total volume, stats here

ICYMI.

Today’s news bulletin:

Become your own bank.

It’s time to ditch your bank altogether and embrace the crypto life:

Spend it directly with no fees on the sale, and earn 3-5% back on every purchase—debit or credit.

Never sell - live like a billionaire: avoid taxes, compound wealth. Don’t worry about on-and-off ramps or taxes by spending against your balance as credit debt.

Pay off your debt with yield + cashback: earn 9% on stables, 7% on ETH, 2% on BTC, with HYPE and SOL on the way.

Use borrow mode: 70% LTV against your whole portfolio, “only borrow, never sell”

Keep self-custody, earn big yield, and never pay for instant withdrawals or have your money stuck in a CEX again.

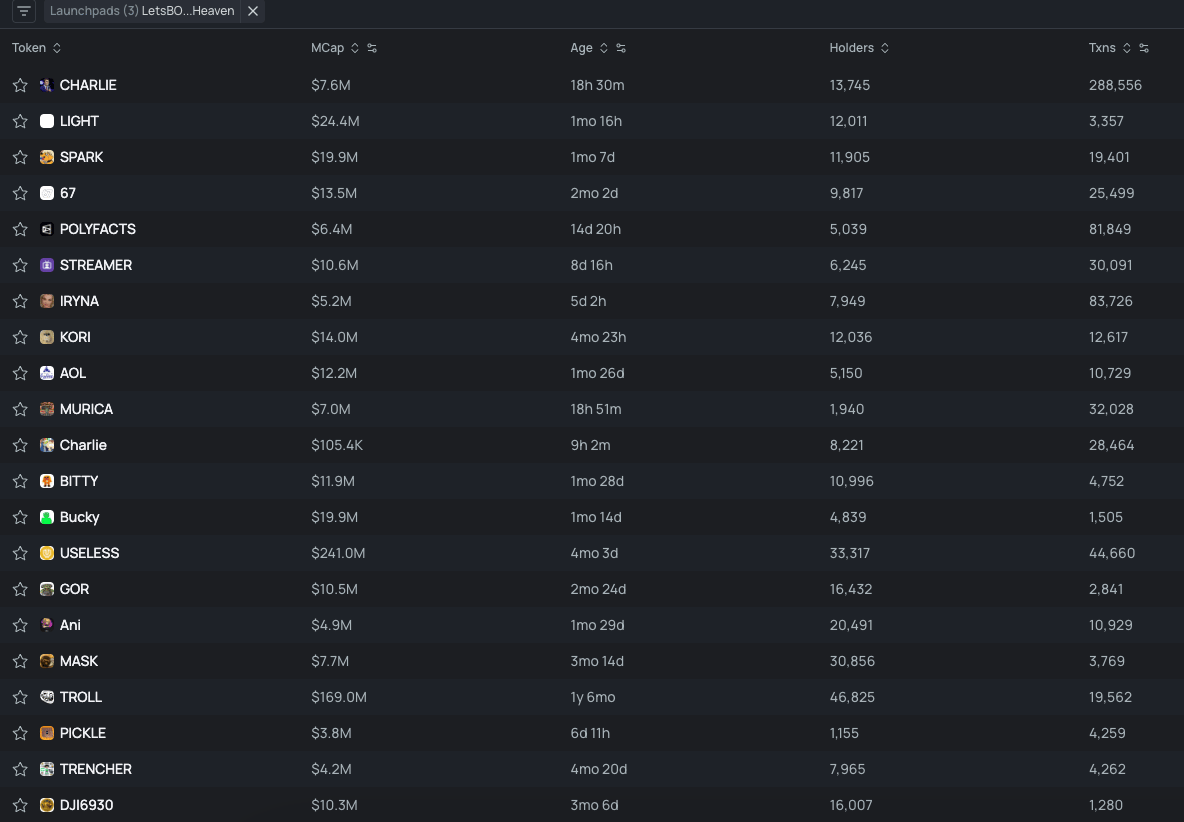

PumpFun + Heaven + Bonk trending tokens for the last 24h:

If you want to access more of this type of data and trade freshly graduated tokens on PumpFun of Bonk, visit Telemetry here (it’s free).

TONS of alpha in today’s Sidelined episode. I’d say watch now if you missed the livestream.

To save you doom scrolling.

Keep going anon, keep going.

We might be at crossroads right now, but the key is to keep moving forward with conviction. In other words, keep stacking high performance, low maintenance coins in your portfolio and you’ll be just fine.

With Hix0n returning tomorrow, I’m gonna switch back to reader mode.

Until next time!

Lavina 🫡