GM, so it begins.

We’re stepping into what’s easily the most jam-packed, high-stakes week we’ve had in a while—the true, capital B Big Week. Everyone expects madness as the most schizophrenic of presidents keeps adding to the fire. Will the tariffs be as bad as everyone thinks? I have no idea.

Besides the so called amazing “Liberation Day” and tariff rollout on Wednesday, expect volatility around April 4 unemployment and April 10 inflation data.

There’s more to this whole mess, though. Looking at Japan, their stock market fell around -4% already in preparation for Trump’s tariff show. Are we also supposed to be afraid of the carry trade blowing up again? Well, at least last time, it was around the bottom.

Let’s look at the bright side. If BTC doesn’t decisively fall through $76k and with higher timeframe closures, this whole mess might still be salvageable.

Moreover, credit markets start to show cracks after a while. This one is a biggie for the Fed and might push them to action if things start to blow up.

Also, the bearish sentiment is hitting extremes. In early March, the American Association of Individual Investors (AAII) survey showed that over 60% of investors were bearish, a figure that has only happened five other times since the survey began in 1987.

The last time we saw sentiment go this bad was July 2022. This was exactly around the bottom and half a year before the real uptrend started on crypto.

Also, Bitfinex whales, which are a notoriously precise indicator, are positioned vastly long Bitcoin.

👇 And if you haven’t yet, hit subscribe below 👇

The important bits.

Superseed teases token generation event coming soon

Sonic launches native LBTC

Peapods Finance announces Berachain vaults for April 9th

Core DAO explains the next step after Bitcoin ETFs - powered by Core

OOGA airdrop on Berachain might be coming soon, teases Kevin

Ramen Finance announces Ooga Booga presale

Shadow Exchange flipped Aerodrome in revenu

Nirvana Finance opens whitelist opportunity, join here

KittenSwap teases airdrop/whitelist for Hypio, MechaCats and Hypers NFTs

Hypio NFT announces a trading competition, begins tomorrow

Initia announces airdrop, check you allocation here

Stargate is now live on HyperCore (Hyperliquid)

Even more important bits.

FTX will start repaying major creditors on May 30 using $11.4B in cash reserves

Japan’s FSA is drafting a bill to classify cryptocurrencies as financial products

Watch out for a new wallet drainer scam through Cloudflare

President Trump's reciprocal tariffs on Wednesday may impact as many as 25 countries

Trump says he “won’t rule out a 3rd term”

Mara to sell another $2b in stock to stack Bitcoin

Bloomberg writes about the “Death of Ethereum”

President Trump has pardoned BitMEX co-founders Arthur Hayes, Benjamin Delo, and Samuel Reed

Michael Saylor's 'Strategy' buys 22,048 Bitcoin worth $1.92 billion

Charts and stats of the day.

Gold prices officially surge above $3,150/oz for the first time in history

Ethereum’s 24h revenue drops below $100k

Hyperliquid continues to dominate the perpetual markets volume

Households have allocated 29% of their financial assets to stocks, an all-time high

HyperEVM is seeing massive inflows

Crypto taxes? Absolute pain.

Sifting through receipts, crunching numbers — it's a yearly ritual of suffering. Throw crypto into the mix, and it’s full-blown chaos.

Now you’re juggling transactions across wallets, flipping between CEXes and DEXes, and wondering if that airdrop was a win or just a taxable headache. And let’s not even start on staking rewards…

Well, it doesn’t necessarily have to suck.

Crypto Tax Calculator is built for degens like you. With over 1000+ integrations, a custom shitcoin pricing oracle, and the superpower to handle your on-chain terror.

You can either generate reports your accountant will love or directly file ‘em yourself.

Snag 20% off your first year. Your accountant — and sanity — will thank you.

EDWIN/SOL Raydium 1D

Edwin is a relatively new, open source DeFAI framework. Price just reclaimed the high timeframe support level (red line). Market cap is still relatively low at $6m and it looks like it wants to grind higher from here. The team is doxxed and making their way round the conference circuit, so it looks like they’re in it for the long haul - something that makes them stand out as the AI x crypto space has been going through a bit of a downturn lately.

Come by the Lucky Luke Discord channel for comments, to roast my picks or to pump your own bags. All banter is welcome any time!

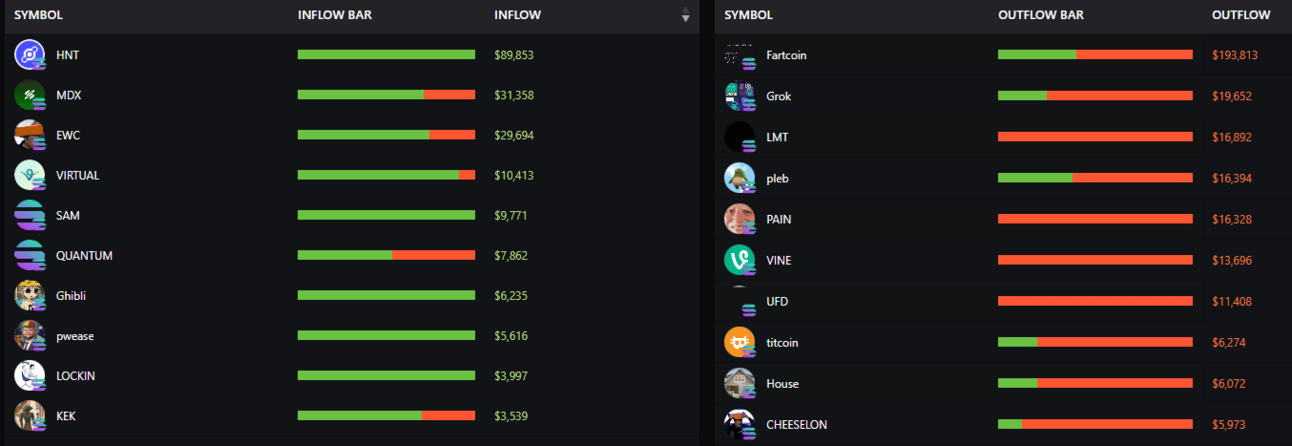

Smart money on Solana seems to be positioning out of memecoins, and into utility. We spoke about Helium (HNT) and other DePIN picks in recent newsletter.

Source: ChainEdge

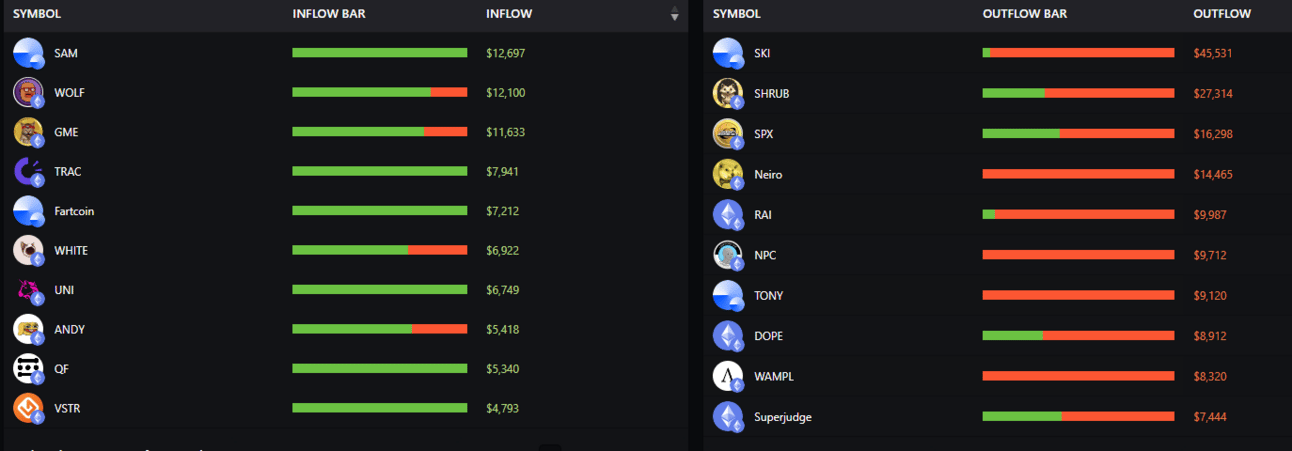

Smart money on Ethereum is once again, a nothing burger. Low volumes, no real signal.

Source: ChainEdge

Grass Sion Upgrade

AI x DePIN network Grass just underwent a major upgrade. The chart looks a little better than most other plays in the space, although the downtrend is still active. It’s one to watch. The protocol, which centers around redistributing unused Wi-Fi bandwidth, saw explosive growth—15x more users in 2024—and this upgrade is pitched as an opportunity for yet more growth.

Moby AI - Data-driven AI Agent

Everybody is fed up with reply-guy agents on X, spamming up the timeline, but Moby AI is still ticking along, sharing actionable, data-driven alpha that is refreshingly useful. The chart is pretty beat up, as are many AI plays right now. When the AI x crypto price action turns around, as it inevitably will, this one to check up on. In the meantime, I have it on notification,s as it’s dropping some genuinely good alpha.

Omen: AI-driven Polymarket Trading

Omen is an agentic hedge fund staffed by a swarm of bots; all focused on a different prediction market niche. Built on Spectral’s Lux Framework, agents scan world events 24/7 and manage bets directly on the Polymarket platform. The launch date is not yet specified. Follow their first bot, Polly, on X and sign up to the waitlist for early access.

Omnia (Gaming) - Sign-ups now opened

Hydros (Hyperliquid)

WizzWoods (Gaming) - Token launched yesterday

Fat Bera (Berachain)

To save you doom scrolling.

ETH/BTC is at levels previously seen only when zero dApps were deployed. Meanwhile, Vitalik is meowing at robots and studying their asses. I don’t know what to think anymore.

Will Ethereum survive?

Bitcoin and Ethereum are closing Q1 with the WORST returns in 7 years. Not many expected this during the first few weeks of 2025, but here we are.

This is all a reminder to always expect the worst, even though it looks like the best is right around the corner. Now, let’s hope this works inversely as well.

stay safe homies,

Hix0n 🫡