Become your own bank.

It’s time to ditch your bank altogether and embrace the crypto life:

Spend it directly with no fees on the sale, and earn 3-5% back on every purchase—debit or credit.

Never sell - live like a billionaire: avoid taxes, compound wealth. Don’t worry about on-and-off ramps or taxes by spending against your balance as credit debt.

Pay off your debt with yield + cashback: earn 9% on stables, 7% on ETH, 2% on BTC, with HYPE and SOL on the way.

Use borrow mode: 70% LTV against your whole portfolio, “only borrow, never sell”

Keep self-custody, earn big yield, and never pay for instant withdrawals or have your money stuck in a CEX again.

GM, the size of this week is increasing by the day.

The moment BTC slipped below the $116.8k area we kept mentioning last week, things turned south fast. As is tradition during market dips, multiple FUDs are appearing. Perhaps the most significant one here is Saylor announcing changes in the “MSTR Equity ATM Guidance”, which is, by some, touted as “pulling the rug”. You can read the main FUD take here.

Nevertheless, more volatility is on deck with Thursday’s FOMC minutes and mainly Powell’s Friday speech at Jackson Hole, which will dictate the mood and odds of the September rate cut scenario. Currently, the odds dropped only a bit, to 89%. You can monitor these here.

Now, to the price map: short term, BTC needs to hold above $113.9k and higher to give us a bounce. The target should be around $118k (mapped out here), which is currently the weekly high. If BTC manages to start closing above, we can likely conclude this dip is done. If there’s yet another rejection, the likelihood of revisiting the recent lows around $111-112k will increase.

What’s important to note here is that this area definitely makes sense for a bounce, especially looking at the SOL chart here, and a very similar picture with ETH here. But, as we know, obvious areas such as these can easily be faked out.

Looking at the current sentiment, it adds viability to the bounce scenario, as most participants quickly turned into Bear mode. This is good.

As we said, this is indeed a Big Week, and with it, there’s also a chance for a White Swan to emerge from the current Trump and Europe talks with Russia. Here’s a great breakdown of the current geopolitical situation and the possibility of a peaceful resolution.

Once again, let’s hope for peace, prosperity, and many more months of shitcoin pumps. For now, this situation seems to me as yet another pullback, or perhaps a wider consolidation, but not a market top.

👇 And if you haven’t yet, hit subscribe below 👇

The important bits.

Giza publishes new “Autonomous Finance” trailer, watch and try it here

Fuel Network showcases real-time transaction speeds, watch here

Jumper teases a new chain integration, read here

Almanak announces the public sale date for August 21, join here

INFINIT V2 beta is now live, join here

Mira Network launches a reward campaing, sketch your PFP here

Tari spaces are happening later today, join and listen here

Plasma published a new episode of “Where Money Moves” newsletter, read here

Kyan explains the “combo trade system”, learn here

Shadow Exchange offers $10,000 rewards od staked S, join here

Hyperliquid deploys USDT0 trading pairs on mainnet, read here

Marinade Finance TVL hits an all-time high at $2 billion, chart here

Heaven launchpad statistics are looking better by the day, see here

Berachain’s BERA open interest is quickly rising, see here

Even more important bits.

Tether appoints White House Crypto Council exec Bo Hines as Strategic Advisor, read here

Axiom trading terminal explained in a new blocmates article, read here

Chamath launches an “American Exceptionalism” DeFi SPAC, read here

ETHZilla unveils rebrand and begins trading on NASDAQ under ticker ETHZ, read here

Bettors on Kalshi are backing Google’s Gemini to take the lead in AI, read here

Google increases stake in Bitcoin miner TeraWulf to 14%, read here

Tom Lee’s Bitmine buys another 378,000 ETH, read here

Charts and stats of the day.

Bonk revenue falls to an all-time low, Heaven takes the leading uptick, dashboard here

Digital asset treasuries now control over 2% of the total ETH supply, chart here

USDG supply grows rapidly, chart here

Google Trends for “altseason” dropped back to lows, chart here

910,461 ETH worth $3.9B is currently stuck in Ethereum’s exit queue, chart here

Telemetry data of the day.

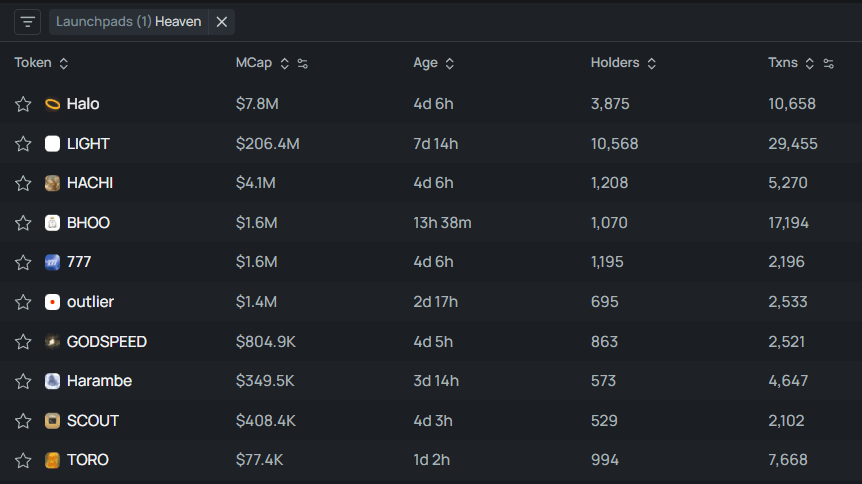

The Heave mania continues. Here are the most trending tokens on Heaven for the past 24h:

If you want to access more of this type of data and trade freshly graduated tokens on PumpFun of Bonk, visit Telemetry here (it`s free).

New HyperEVM point farm unlocked.

HyperFlow caught my eye today after seeing it hyped up by Mister ScottPhilips.

HyperFlow is currently the only DEX aggregator on HyperEVM offering real-time swap rate comparisons across all other DEX aggregators in the ecosystem. I can confirm that clicking through three or four aggregators while trying to find the best rate for my BUDDY buys wasn’t fun.

Personally, I’ll start stacking points here and using HyperFlow anytime I want to trade on HyperEVM. You can join me here, if you want, of course.

HyBridge (Hyperliquid bridge) - BRIDGE token coming soon, watch here

To save you doom scrolling.

I can largely see myself in this (unfortunately). How about you? Haha, dayum.

No better way to end off with a solid hit of Hopium.

Firstly, check out this long-term 200 MA indicator. If this holds true, we are about to enter very prosperous times.

Secondly, looking at these liquidation levels, the Bears should sweat as soon as ETH properly bounces.

And finally, for the real students of the grypto markets, here’s an excellent interview with FiboSwanny, a legendary trader who nailed multiple previous macro tops. His target? Well, listen for yourself.

stay safe homies,

Hix0n 🫡