GM, enjoying the “detox”?

Fortunately, it seems that at least Mister Bessent doesn’t think this “detox” period for markets means the U.S. economy is heading into a recession. The only ones who think that seem to be people on Google Trends and every other reply guy on X. So, who’s right?

All I know is that historically, it isn’t the reply guys. Today, we’ve had the PPI inflation data, which, once again, came in softer than expected. Inflation seems to be steadily heading towards the Fed’s 2% goal (which actually isn’t needed for them to cut rates anymore), and the more this continues, the more interesting the next FOMC meetings are going to be.

BTC seems to be getting weaker again after today’s NYC open. Nevertheless, there’s still a good case to be made for this area, or maybe the previous low will provide us with a proper bounce (praying).

What’s interesting these days is watching the TOTAL2 and TOTAL3 charts, which represent the altcoin market capitalization. Even though coins and especially memes are dying left and right, these charts are holding their support.

The conclusion? Fundamentals matter, and once altseason (if you can even call it that) happens, the outstanding protocols and projects will benefit exponentially more than the bottom of the barrel memes and products without PMF.

It’s time for you to study and time for us to provide the best study materials. Stay tuned.

👇 And if you haven’t yet, hit subscribe below 👇

The important bits.

Get ready to participate in Ramen Finance’s Berachain Reward Vault

Maia DAO features Automated Concentrated Liquidity Strategies, here’s how to get the yield

Yeet is releasing the new Berachain “biblical bera bonzi”: here’s how to participate

Ionet explains how you can unlock more GPU scalability with Co-Staking

Sophon releases multiple 4x multiplier reward pools - here’s how to farm them

Mode releases Voting Epoch 5

Nillion announces Airdrop Checker: check your allocation here

Ripple receives approval from the Dubai Financial Services Authority to provide crypto payments

Dinero announces more Branded LSTs to come soon, with $45m already

Even more important bits.

Hyperliquid ETF with BlackRock is now debunked

Franklin Templeton files for a Spot XRP ETF with Cboe

Coinbase now works with 145 US agencies, amid positive regulatory changes

President Trump aims to eliminate taxes for individuals earning less than $150,000

Trump family in talks to acquire a stake in Binance. US

Charts and stats of the day.

Someone lost over $215,000 to an MEV bot swapping USDC to USDT. Use CowSwap for protection!

US tech looks like it's putting in a complacency shoulder after a decade-long bull against Chinese tech

Hyperliquid whale is back, longing ETH and shorting BTC

Stablecoin supply exceeds 1% of the broad US money supply

Bitcoin accumulation addresses are back to stacking sats

Ethereum has faced record active selling over the past 3 months

Crypto taxes? Absolute pain.

Sifting through receipts, crunching numbers — it's a yearly ritual of suffering. Throw crypto into the mix, and it’s full-blown chaos.

Now you’re juggling transactions across wallets, flipping between CEXes and DEXes, and wondering if that airdrop was a win or just a taxable headache. And let’s not even start on staking rewards…

Well, it doesn’t necessarily have to suck.

Crypto Tax Calculator is built for degens like you. With over 1000+ integrations, a custom shitcoin pricing oracle, and the superpower to handle your on-chain terror.

You can either generate reports your accountant will love or directly file ‘em yourself.

Snag 20% off your first year. Your accountant — and sanity — will thank you.

Gold 1W with Bitcoin in orange, M2 Global Liquidity at bottom

Gold is making new all-time highs and pushing towards $3k today. You can see the tight correlation with M2 global liquidity expansions—M2 is the bottom pane—basically the global money supply.

Bitcoin also tracks monetary expansion (debasement) but usually lags by a few weeks. Gold (good for risk-off) is less sensitive to the current bearish sentiment. Monetary expansion usually happens due to some kind of crisis (Covid, the GFC), or structural volatility (Tariffs & other Trump changes).

Once the market has processed these tectonic shifts, I think we’ll see Bitcoin follow the Gold trend. I’m moving slowly. There’s no need to rush in a market like this.

Come by the Lucky Luke Discord channel for comments, to roast my picks or to pump your own bags. All banter is welcome any time!

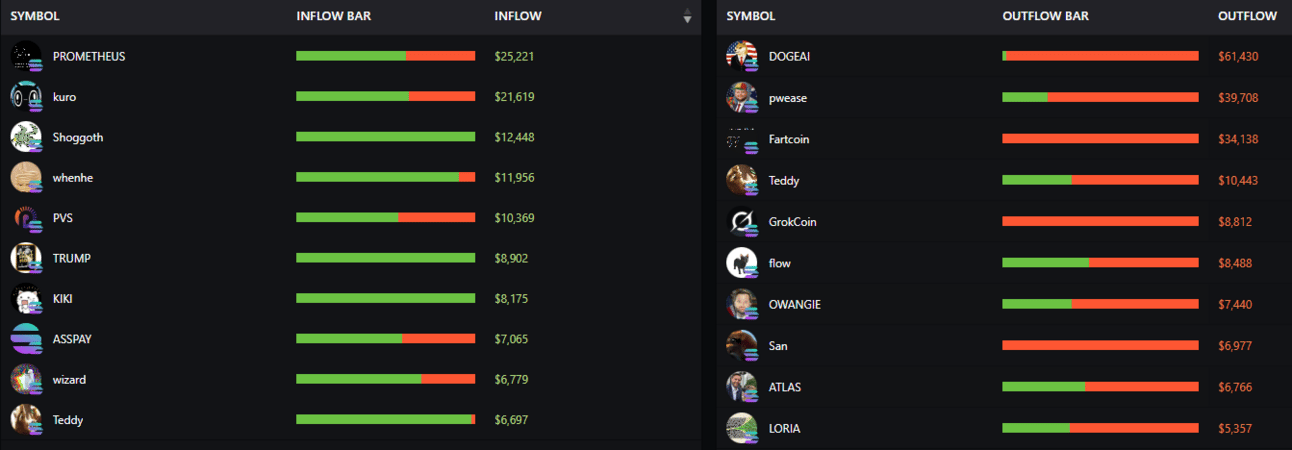

Smart-money movements on Solana for the day showed strong outflows from our “typical” memes, such as Fartcoin or the new favorite Pwease.

On the other hand, AI stuff such as Shoggoth sees inflows. It's important to say that, at this point, I wouldn’t read too much into these. Once the reconsolidations are finished, we can start talking.

Source: ChainEdge

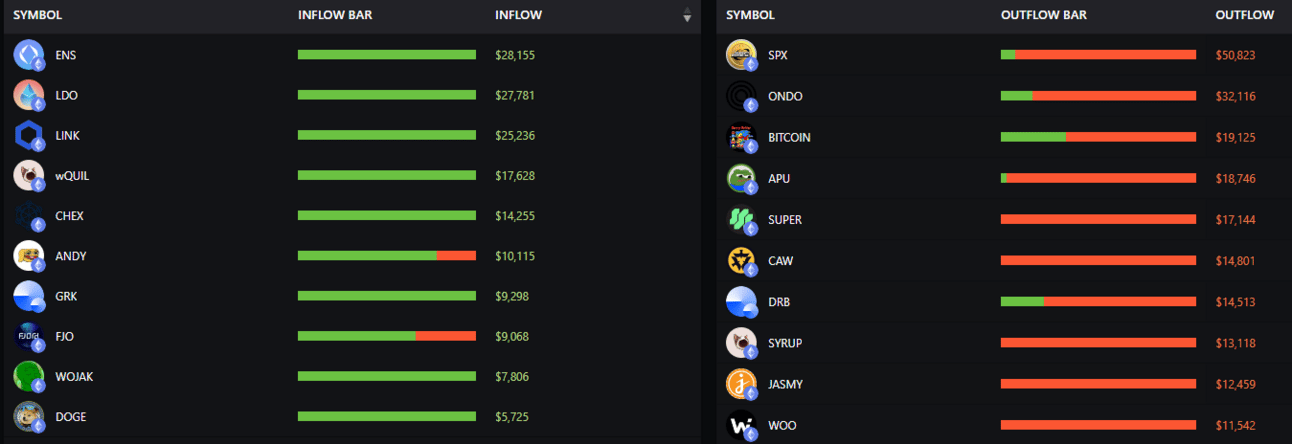

Smart-money movements on Ethereum are more interesting. Memes are clearly suffering, while infrastructure stuff like LINK and LDO are leading. Remember yesterday’s Degen corner?

Source: ChainEdge

Mawari (DeFi)

Hemi (DeFi)

FatBera (Berachain yield)

Burve (Berachain yield maximizer)

Takes . Fun (Share your takes & make profits)

Apptronic (Robotics, AI)

Midnight (L1)

Mole Finance (Sonic)

Quantum Finance (Algorhitmic central bank, Sonic)

To save you doom scrolling.

We didn’t agree to this, Raoul.

Are we going to believe the Orange Man or not? I certainly hope what he says here turns out to be true…

stay safe homies,

Hix0n 🫡