GM, the bears are getting cocky.

Right now, the market is drowning in shorts. If you want proof, just look at Hyperliquid stats right here. Only slightly above 20% of traders are currently long.

Even hedge funds are currently in hard bear mode, dumping global stocks at their fastest pace on record in the 2 weeks ending March 3rd. Institutional investors’ equities exposure reduction was even sharper than during the 2022 bear market. Does this look sustainable?

The bottom might be closer than we think, at least timewise. Could BTC still revisit the recent lows? Sure. But remember, when one side wins for too long, the market flips the script.

The first signs of this were seen after today’s job report. Even though the data did not come out precisely great (more neutral), the mere confirmation that the US was not heading straight into recession pumped SPX and BTC with it.

From a short-term perspective, there’s still a risk of SPX breaking below 5,700 and today’s Crypto Summit being underwhelming, resulting in sell-the-news style price action.

Lastly, after today’s confirmation of the US Bitcoin Reserve, there’s a good chance of secondary order effects resulting in bullish narratives that follow, like pointing towards a scenario where the government actually starts buying BTC or other countries following the Bitcoin Reserve strategy.

👇 And if you haven’t yet, hit subscribe below 👇

The important bits.

Even more important bits.

Nasdaq will offer 24-hours trading

Uniswap Foundation votes on a massive $165.5m USD funding

Bitcoin Reserve Bill SB21 passes in the Texas Senate

Tucker Carlson drops interview with SBF

Dubai's largest bank Emirates NBD now allows customers to buy crypto

Retardio mentioned in Theo Von podcast

President Trump says "globalists are behind stock market sell off."

Charts and stats of the day.

Credit card balances have hit a record of $1.21 trillion

Crypto taxes? Absolute pain.

Sifting through receipts, crunching numbers — it's a yearly ritual of suffering. Throw crypto into the mix, and it’s full-blown chaos.

Now you’re juggling transactions across wallets, flipping between CEXes and DEXes, and wondering if that airdrop was a win or just a taxable headache. And let’s not even start on staking rewards…

Well, it doesn’t necessarily have to suck.

Crypto Tax Calculator is built for degens like you. With over 1000+ integrations, a custom shitcoin pricing oracle, and the superpower to handle your on-chain terror.

You can either generate reports your accountant will love or directly file ‘em yourself.

Snag 20% off your first year. Your accountant — and sanity — will thank you.

DXY 2W - Major Tops & BTC Bottoms

That latest two-week DXY candle is a massive red nuke. It’s only five days old, and already, you will struggle to find a bigger dollar sell-off candle in the past decade. November ‘22 is the only competitor.

What mean? A major dollar top has formed and continuation to the downside is in progress. These have consistently correlated to the biggest Bitcoin bull runs. Usually, there’s a slight lag before UpOnly begins in earnest. See the Covid Crash & November 2022 for examples of this.

Yesterday we highlighted the turnaround in global liquidity, and cheap dollars (above) are contributing to M2 liquidity upside. Bitcoin also tends to lag M2 liquidity runups, and the target for yesterday’s M2/BTC chart was for things to turn around near the end of this month. News catalysts are starting to stack up. Gold is one to watch, because it tends to price in monetary expansion quicker than BTC.

Come by the Lucky Luke Discord channel for comments, to roast my picks or to pump your own bags. All banter is welcome any time!

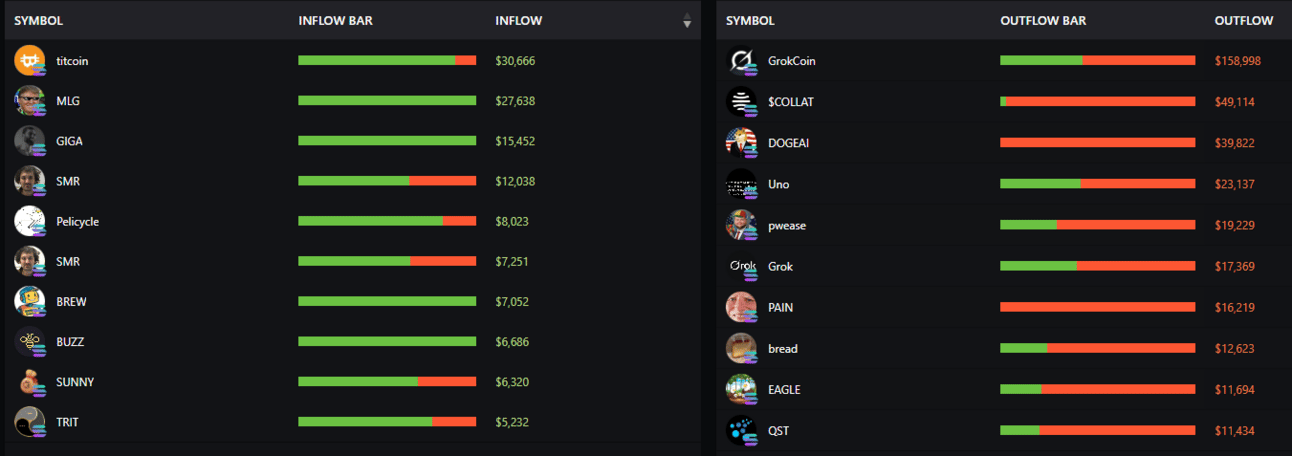

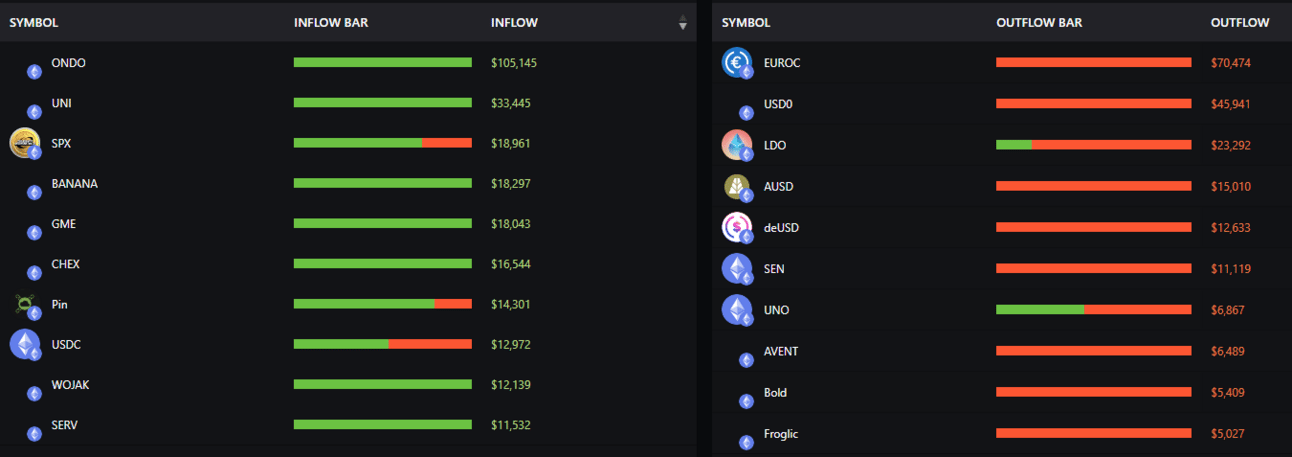

Smart-money movements on Solana.

Source: ChainEdge

Smart-money movements on Ethereum.

Source: ChainEdge

Life gets busy so here’s what you’ve missed.

MODE: Pioneering the DeFAI space with synthetic data.

Research

The DeFAI sector has been on our radar for quite some time, and Mode is straight-up wilding.

The chads here are creating a synthetic data layer for AI agents powered by a Bittensor subnet.

Basino (Berachain)

BakerDAO (Berachain DeFi)

HyperYield (Hyperliquid DeFi)

LoopedHype (HYPE looping to increase yield)

proception (Humanoid startup, AI)

To save you doom scrolling.

I’m not sure I like the way we’re going…

There’s technical analysis, fundamental analysis, and then there’s Cramer analysis. And it says we’re very close to the bottom. Do with that information what you will.

stay safe homies,

Hix0n 🫡